Editor: Emanuele Marabella

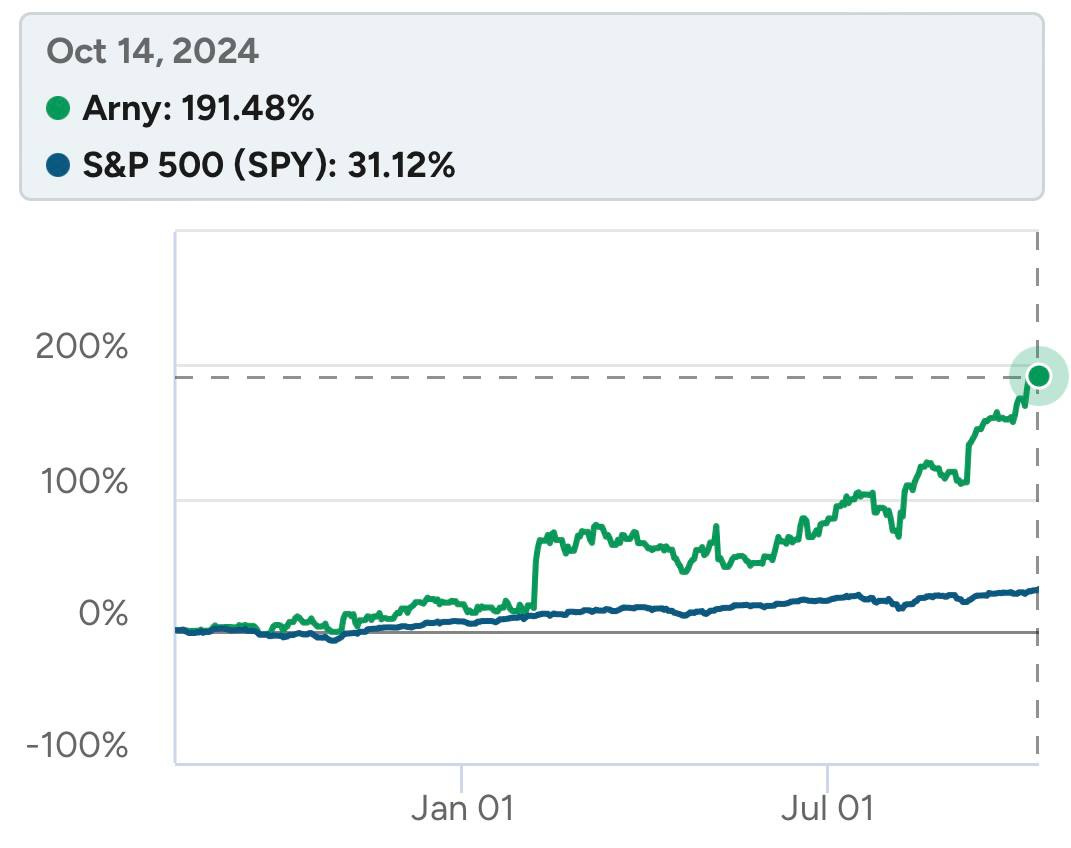

In August last year, I started a public portfolio to establish a track record of my investment approach focused on spotting asymmetric opportunities.

While my goal of seeking a ~30% annualized return is ambitious, the results so far exceed my rosiest expectations:

+191% return, which consists of ~160% overperformance vs the S&P500.

I didn’t use any leverage or options.

Here are the critical lessons I learned:

Concentration is good. If your conviction is backed by solid analysis, you should embrace being concentrated.

Concentration is risky. You can sleep well while being concentrated only if you invest in great companies bought at an asymmetric price. Otherwise, avoid it at all costs.

Act as an orca, not as a puppy. Orcas study prey and act opportunistically. Puppies eat whatever food they find.

A few moments can be defining. Don't miss them. Going all-in Palantir at ~$15 before 23Q4 results and again before 24Q2 generated almost half of the performance.

You are always on time to increase beta, not the opposite. Be sure you are not overexposed when conditions are not favorable. Increase beta when fear rises.

You can beat the market, but that's not easy. The reward/effort is probably not worth it unless you are dedicated to seeking superior opportunities.

Spend time on things that compound. Rather than compulsively seeking new investment ideas, master the few ones you are convinced about.

Keep the portfolio at a level you are confident in. If swings make you emotional, it's better to reduce the size of the portfolio.

Invest against your own emotions. Even the most trained investors have emotions during market swings. The difference is that winners act against their impulses rather than being slaves to them. Train discipline!

Narratives have value. When you deal with a railroad, it's all about the numbers. The story rarely changes. In tech, it's all about the convergence of fundamentals and story. When the equity story improves along with fundamentals, you have explosive returns (e.g., Palantir and Robinhood)

Be a maniac. Discuss with maniacs. You can capture slight hints from management words when you know the details of the companies. When you discuss them with other maniacs, knowledge explodes.

Without asymmetry, it's not “value.” It's a trap. If you can't explain the asymmetry between perception and reality, you are probably not getting a good deal.

Complexity is the enemy of performance. When you are concentrating, minimize the BS that enters your brain. Follow an information diet (i.e., minimize macro BS).

Focus on not being wrong rather than being right. Seek fallacies in your thesis. You are confident when you can prove all bears’ thesis wrong.

Expensive doesn't mean overvalued. “Expensive” means multiples are relatively high compared to peers or history. It becomes overvalued only if the prospects are too optimistic. To understand the difference, you must be a maniac of the company’s business.

Position sizing matters as much as picking. Start slowly initially and strike heavily when the opportunity manifests itself. Take positions that reflect your confidence, weighted by the opportunity size.

Focus on not overpaying rather than max profits. With growing companies, an appealing valuation is when "I am sure I am not overpaying.” Be sure fundamentals make the story strong.

Portfolio as of today

As of today, I am primarily invested in Palantir (~75% of the portfolio) and the rest in cash.

If you wish to follow closely Palantir’s path to “take the whole AI market,” join +6,000 investors at my other newsletter, Palantir Bullets:

Here are a few investment thesis companies I love:

What’s next?

A year of track record is insufficient to judge an investor's skill.

Yet, these lessons shaped my learning and will set the basis for the coming years, which I look forward to sharing.

Yours,

Arny

Reach me:

Disclaimer: The views and opinions expressed above are current as of the date of this document and are subject to change without notice. Materials referenced above will be provided for educational purposes only. None of the above will include investment advice, a recommendation or an offer to sell, or a solicitation of an offer to buy, any securities or investment products

Very well done! I thought my 50% in Sea Limited is nut but yours in PLTR is incredible!

Phenomenal stuff Arny! Realized I’ve been following almost all of what you have listed here, but you’ve written it so clearly and insightfully. Appreciate it.

And thanks to you, Amit, Emir and others, you all are a great team.