Editor: Emanuele Marabella.

Abcellera (NYSE: ABCL 0.00%↑ ) is a technology company disrupting the antibody discovery industry.

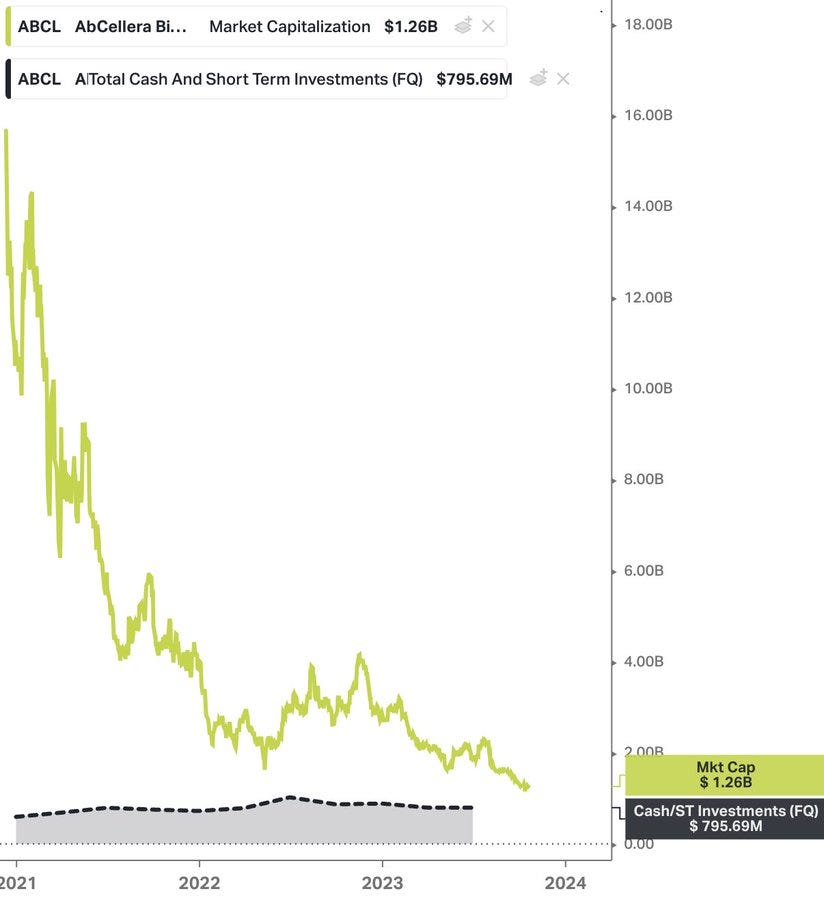

The current ~$4 price implies that we can purchase a proven drug discovery engine that generated ~$1bn of royalties from a single success case and over 100 programs, currently under development, almost for free. This creates an asymmetric opportunity.

In this article, I’ll explain my ABCL thesis in a few charts.

AbCellera is as fascinating as it is complex. In this short article, I will focus on the key points of my thesis rather than a full breakdown of the business.

Proven tech, for free

AbCellera at $4 is equivalent to paying $1.2bn for a company with $800 million in cash and:

Proven tech to identify new molecules;

9 molecules in clinic;

150+ programs with royalty opportunities (~80 already started)

15 fully owned programs;

$200 million worth of property, plans and equipment (PPE);

$200 million of Canadian government funding.

Ok great, but what does AbCellera actually do?

AbCellera discovers the best antibodies to develop drugs by leveraging its tech platform.

This short clip helps visualize it:

A portfolio of molecule options

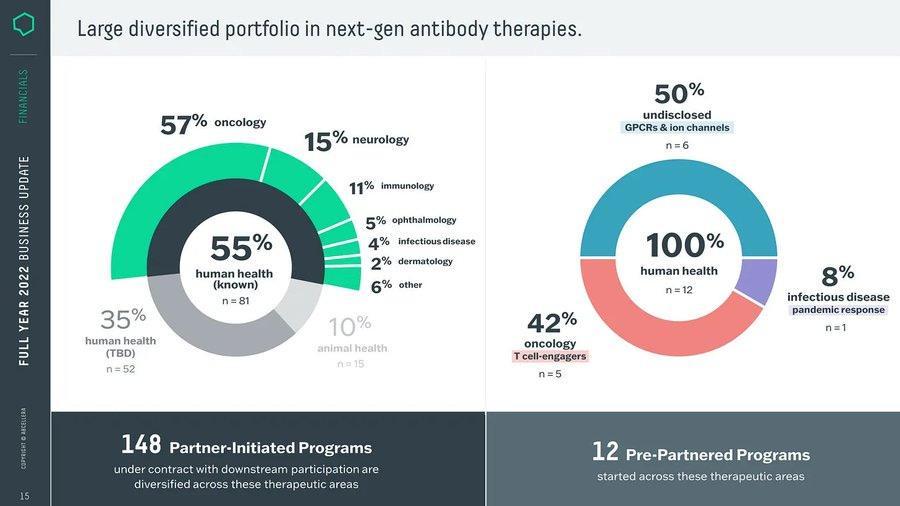

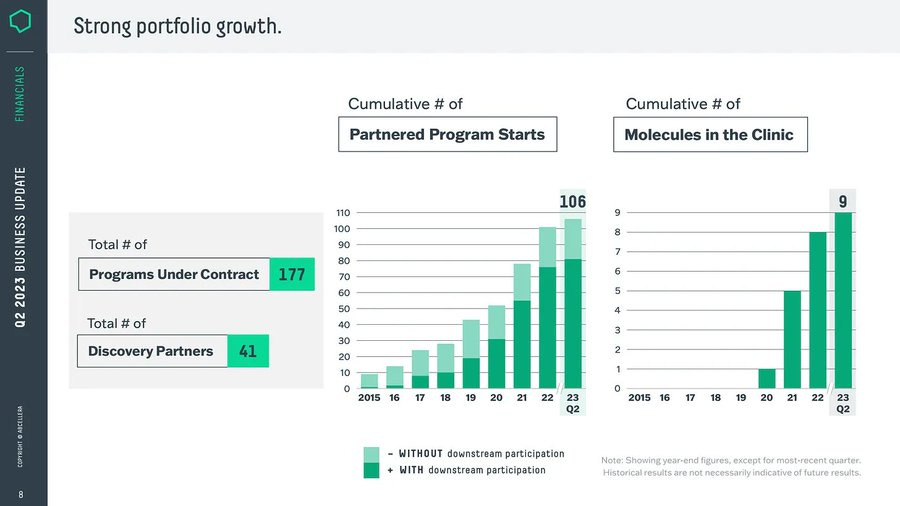

AbCellera can be seen as a diversified portfolio of ~95 antibody programs with royalty capabilities.

Molecule portfolio value = (NPV of molecule) * (number of molecules)

The value of the portfolio increases by progressing existing molecules and by increasing the number of programs.

Each molecule program developed by AbCellera is essentially a long-term deep OTM call option with a ~10% success rate after 9 years which could generate over ~$800mn in royalties and milestones.

Expected timeline for each program:

~3 years for the discovery and preclinical phase;

~5 years for the FDA phases;

~5 years to reach peak sales.

AbCellera, with downstream programs, is entitled to receive ~4% of the Revenues from the sales of the antibodies discovered in royalties.

Note : Abcellera doesn’t incur costs from the product commercialization which allows them to pocket a pure FCF.

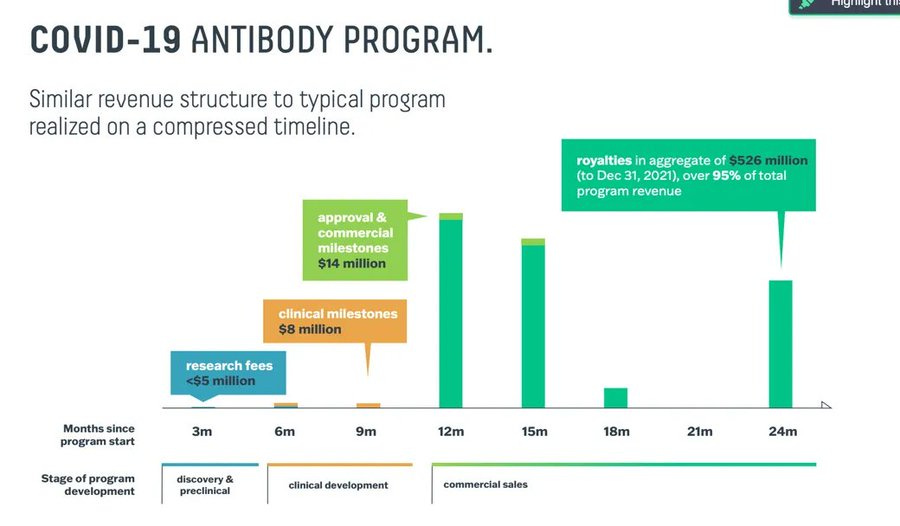

AbCellera proved the quality of their tech during Covid19.

In only 3 months they developed the first antibody.

Eli Lilly, the partner of the program, sold the antibody and generated ~$1bn in Revenue for AbCellera in royalties.

Currently, AbCellera has no Revenues from royalties as the antibodies became ineffective vs the new variants. The new antibody is now under review.

Not a “YOLO biotech”

Classical biotechs go "YOLO" (You Only Live Once): they raise cash to create a drug candidate and they hope to obtain commercialization approval (~10% chances) before they run out of cash.

Inversely, Abcellera operates as a tech company with a powerful flywheel which can be seen as an option generator.

As the flywheel spins faster, more options are generated:

partners►programs►data►accuracy►speed►molecules►programs►[repeat]

This creates a paradigm shift in the risk of the business.

Any single program that AbCellera runs can fail without compromising the overall health of the company.

The risk is for the tech platform to stay top-notch and improve as time passes to be able to “digest” more programs with increasingly better chances of success.

In other words, AbCellera has a “tech risk,” not a specific “biotech risk.”

That’s why the proven case during COVID-19 is immensely valuable: the AbCellera platform worked, even with very short timelines.

Partner of choice

AbCellera has partnered with 40+ drug developers of all sizes.

All the "big pharma" are AbCellera partners. These companies use AbCellera to pursue antibody targets. This way they transfer the risk from their own R&D programs to the AbCellera capabilities.

AbCellera provides partners with its Drug discovery capabilities, which are extremely science/tech-intensive.

The GMP/CMC facility, to be finalized in 2024, should accelerate the pre-clinical phase of the programs. We can consider these GMP/CMC facilities useful to assess the "recipe and instructions" of the antibody.

Promising Cancer antibodies

Among the programs AbCellera is developing, the “pre-partnered” programs, now 15, which seem to offer potential major upside.

These consist of the use of its own platform and R&D to develop fully owned assets.

In other words, AbCellera uses its tech to identify a specific drug candidate, which can be then sold to partners for commercialization (royalties).

The focus is on cancer antibodies, which seem promising vs benchmarks (read here)!

Furthermore, AbCellera is currently waiting for the approval of its third COVID-19 antibody.

If this is approved, more Revenue from royalties should come.

Unlocking a $400bn market

AbCellera solves the biggest issues of drug development:

Time: 9 to 12 years from initiation to drug approval;

Cost: ~$3bn per drug development;

Failure: ~90% of candidates fail to reach approval.

These create a strong disincentive to invest in drug development.

AbCellera faces a huge opportunity as the leading company in the Commercial Antibody Medicines market, which is expected to reach $400bn by 2030.

Downside floor, unlimited upside

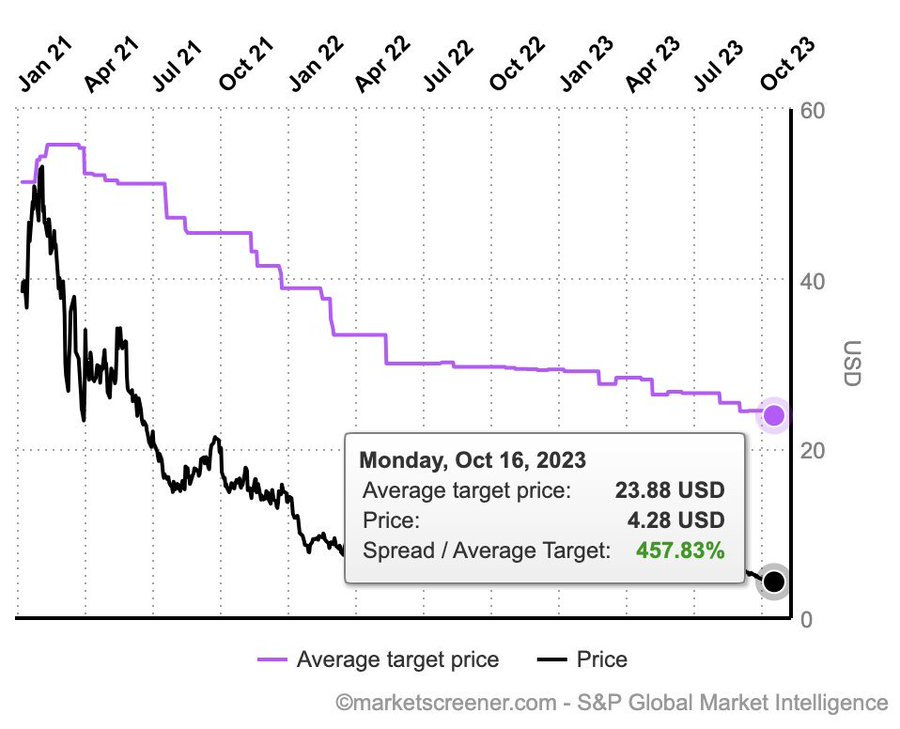

AbCellera analysts target a $24 price per share, which is ~6x the current price.

Maybe too optimistic? As a reminder, AbCellera has almost no Revenue at this point.

We can perform a raw valuation on AbCellera using the “portfolio approach” discussed earlier.

The molecule portfolio could be worth ~$1bn, obtained from:

$11mn as value of each program (15% disc rate, 10% success rate);

95 royalty programs started.

By adding the ~$800mn Net Cash we obtain a ~$1.8bn Market Cap, or $7 per share (63% upside).

However, these calculations exclude a key consideration...

AbCellera molecule portfolio is not static:

20-30 programs are started each year (probably more with GMP / CMC);

As each program matures the value of the portfolio increases.

Therefore I don't see absurd AbCellera returns in the coming years.

Conversely, I believe the downside should be limited by the $800mn in Cash (35% downside).

Despite an appealing setting, there are some key risks:

Interest rates: pure enemy of biotech valuation;

Cash burn: now moderate at $50mn/y, which can also increase;

Impatience: may need 2-3y before something important happens;

Competition: currently ahead in antibody, but success may attract challengers;

Key CEO: serious risk if something happens to him.

Other interesting elements:

Peter Thiel is on the board;

CEO received substantial funding from the Canadian Government;

Insiders are buying aggressively.

Please hit the ❤️ button if you enjoy today’s article and share it!

Conclusion

AbCellera is an early-stage company that successfully proved its value proposition in the most challenging era, in record time.

The current price implies that its promising role in the antibody discovery market could be bought, essentially for free.

Given the above, I started a position in AbCellera.

Yours,

Arny

Join me:

Twitter X: @arny_trezzi

Amazing analysis sir!

great research, top quality ... kudos! cheers!