Editor: Emanuele Marabella

Robinhood at ~$9 offers an asymmetric situation with relatively little downside and potential explosive upside.

In this article, I’ll explain my HOOD 0.00%↑ ’s thesis in a few charts.

Volatility is a broker’s food

Brokers like Robinhood make money when people trade substantially due to high volatility. Brokers don't care if the market goes up or down, they care if it moves.

Therefore volatility is a broker's food:

High Volatility = much trading activity = $$$;

Low volatility = low trading = ☠️.

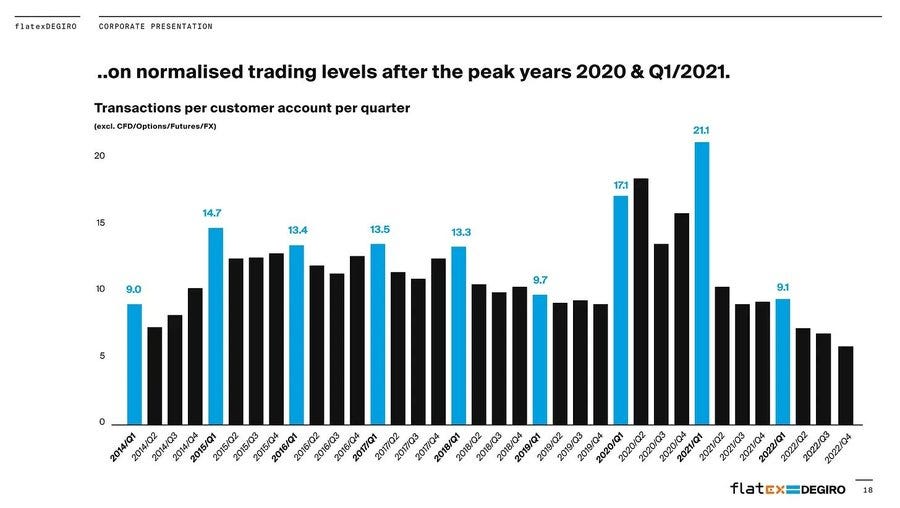

We can see this dynamic from FlatexDEGIRO, the closest alternative to Robinhood in Europe.

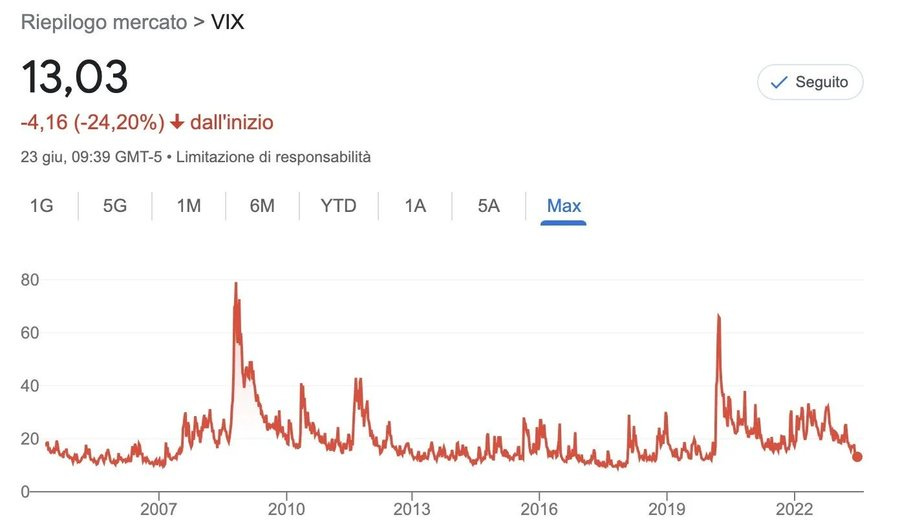

When VIX explodes -> Revenues explode -> Stock explodes.

For instance, FlatexDEGIRO's Revenue grew +150% in 2020 thanks to the spike in volatility combined with low-interest rates.

Since brokers benefit from volatility, investing in a broker means being "long volatility".

Currently, VIX is at nearly record low levels, which is a very adverse environment for brokers like Robinhood.

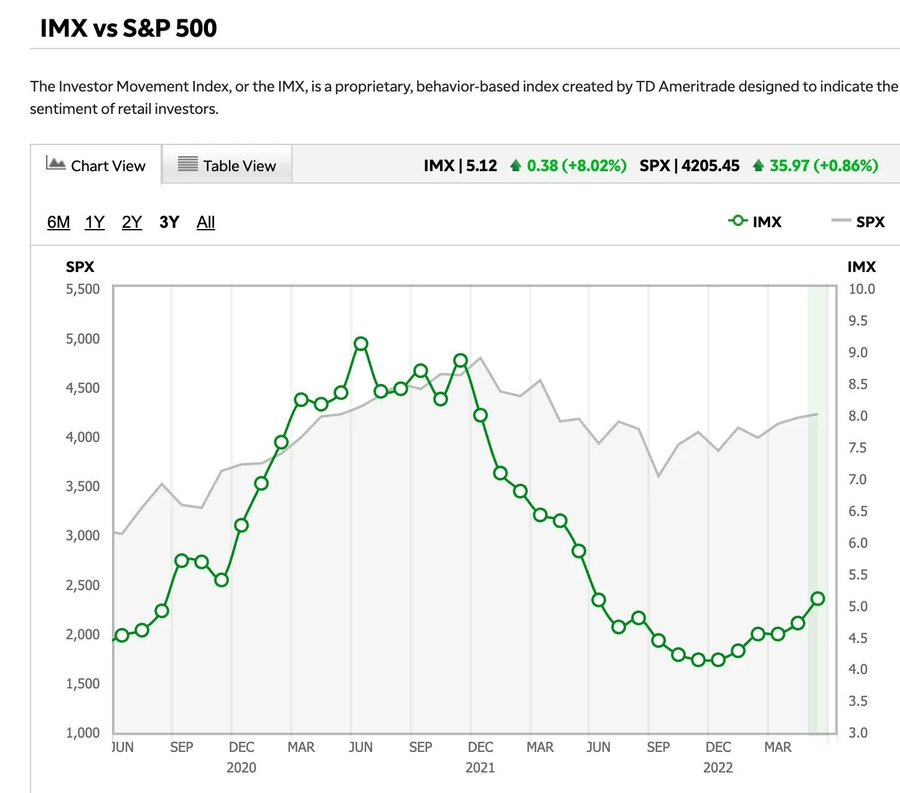

Meanwhile, retail investors are back. After an abrupt 2022 retail investors are returning confident on the market. This is a positive catalyst for Robinhood, which is focused on retail trading.

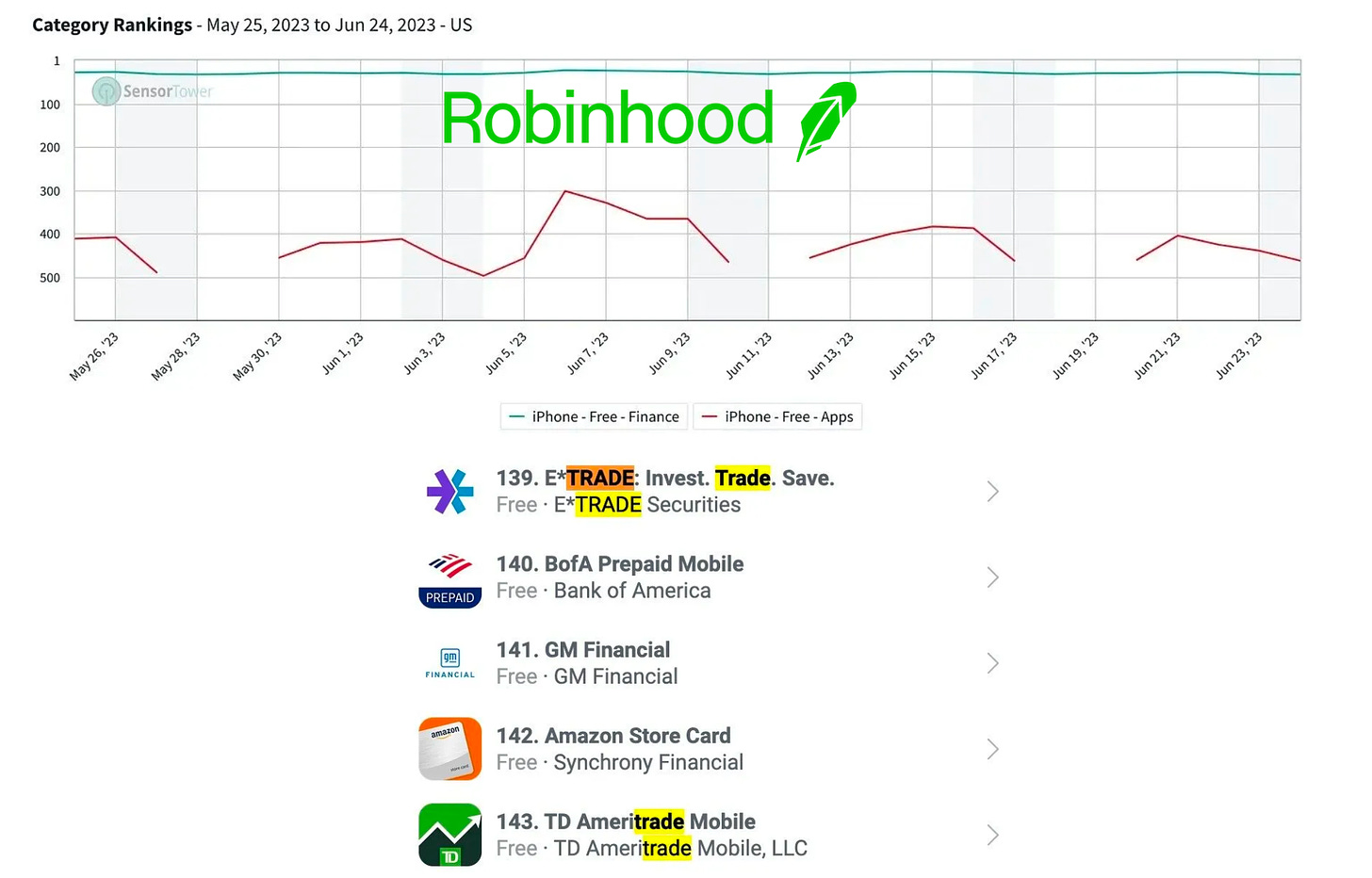

Despite the hate after the GameStop saga, Robinhood remains the most loved "neobroker", standing at #33 position on the App Store/Finance. Competitors such as E*trade and TD Ameritrade lag well behind at the #139 and #143 positions respectively.

Financials

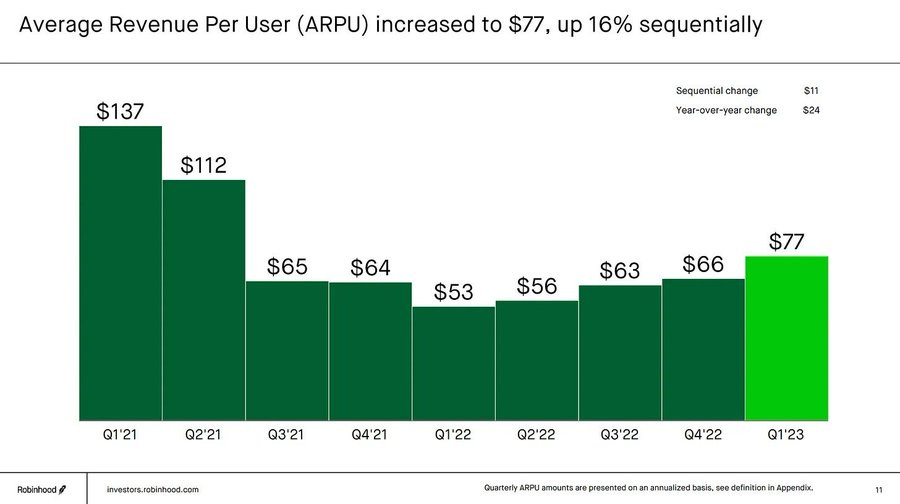

After a dramatic drop, Robinhood’s Revenue Per User is finally recovering despite the adverse volatility conditions.

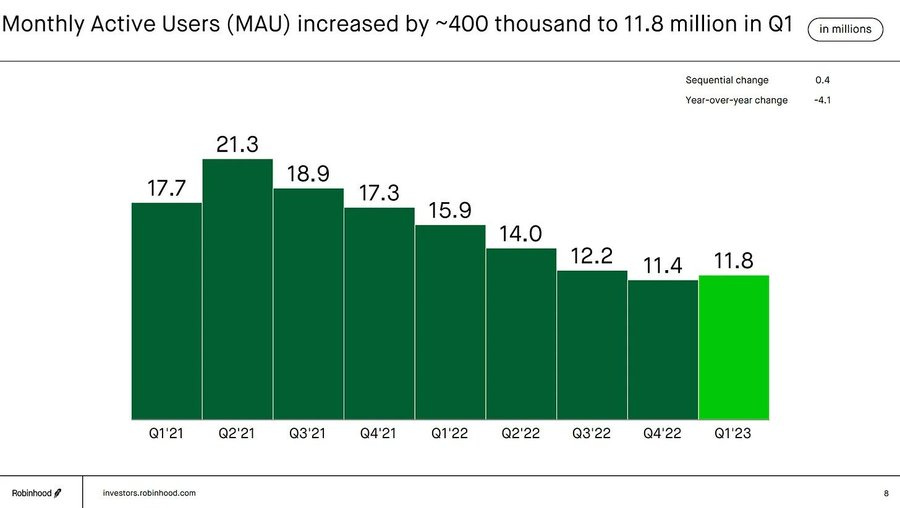

In Q1 Robinhood posted the first change in Monthly Active users breaking the prolonged downtrend.

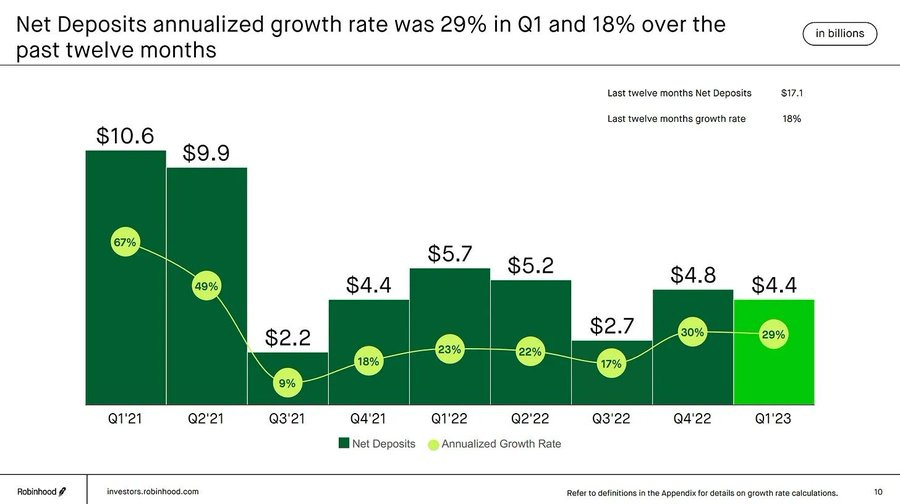

Furthermore, Robinhood had positive net deposits each quarter also amid the recent "bank crisis". This means that the remaining and new users trust the platform.

For any financial company, attracting flows amid the storm is one of the most positive signals.

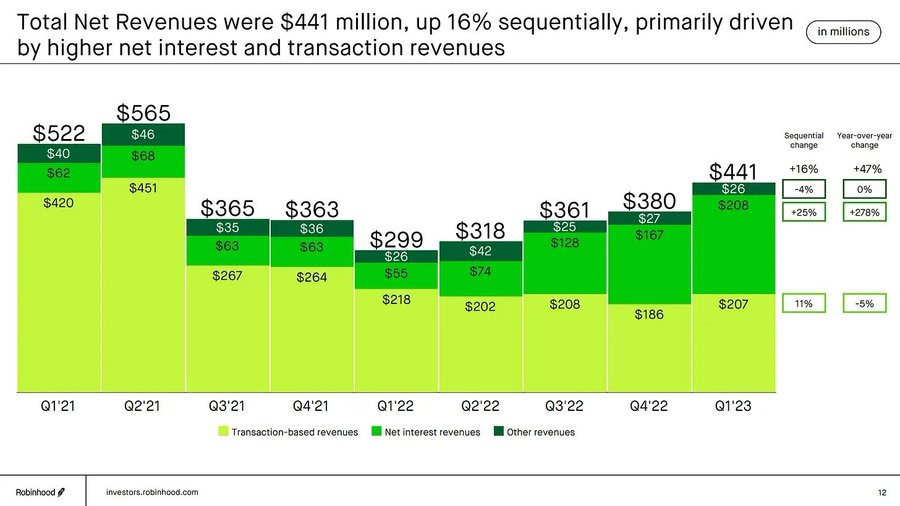

Robinhood business is now more resilient thanks to its focus on Net Interest Income and set to benefit in whatever interest environment:

Low-interest rates -> more transaction Revenues;

High-interest rates -> more interest Revenues.

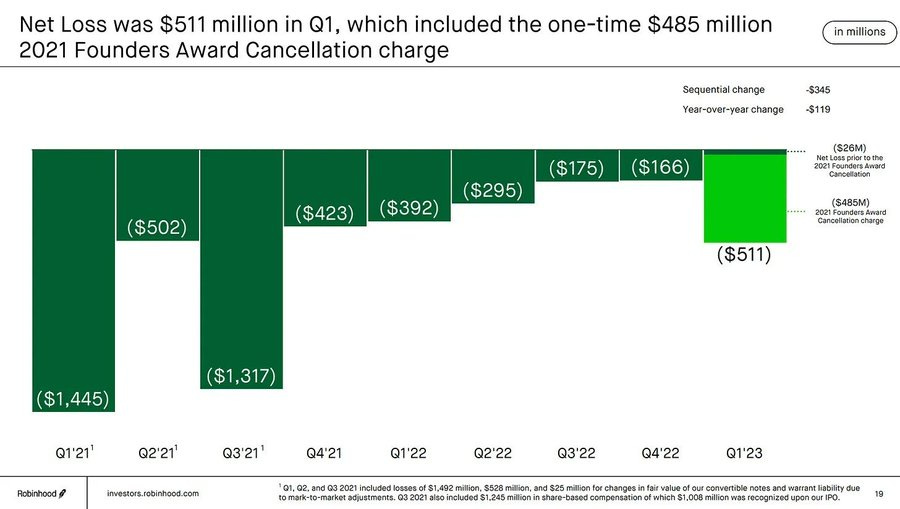

Robinhood almost reached GAAP profitability despite the adverse volatility conditions. Founders canceled their SBC award, but the company needed to record an accounting loss.

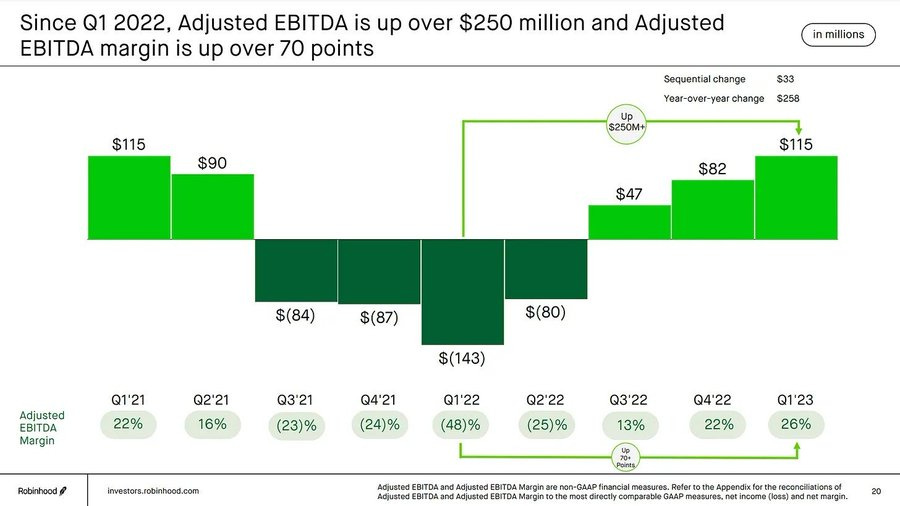

As of 23Q1, Robinhood achieved a higher EBITDA Margin than at peak favorable conditions in 2021. This was achieved thanks to a savage layoff of ~40% of the workforce similar to what Airbnb did.

From here if Robinhood’s business is in an asymmetrical position:

conditions improve (VIX go up) = $$$;

VIX stays low = "ok fine".

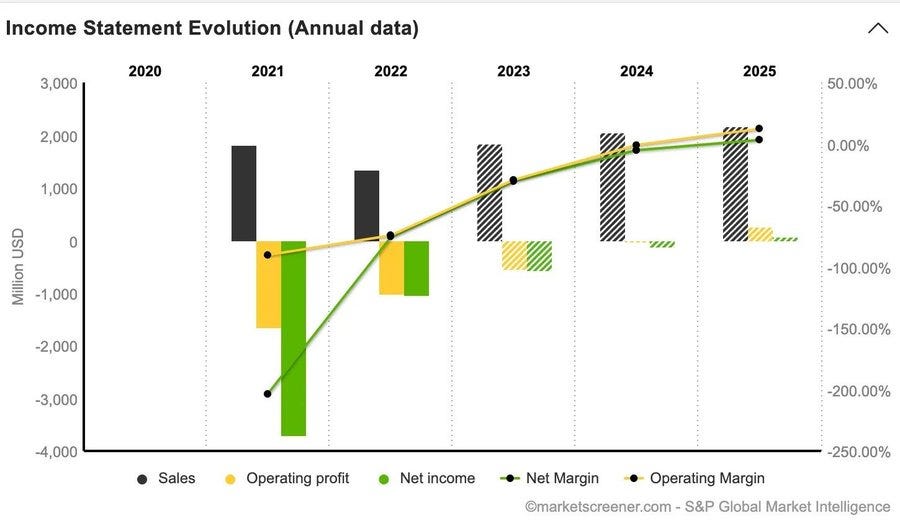

Analysts see GAAP profitability in 2025. However, forecasts for brokers are heavily unreliable because a broker's numbers can change dramatically in little time if a volatility event that destabilizes markets breaks out (eg. COVID).

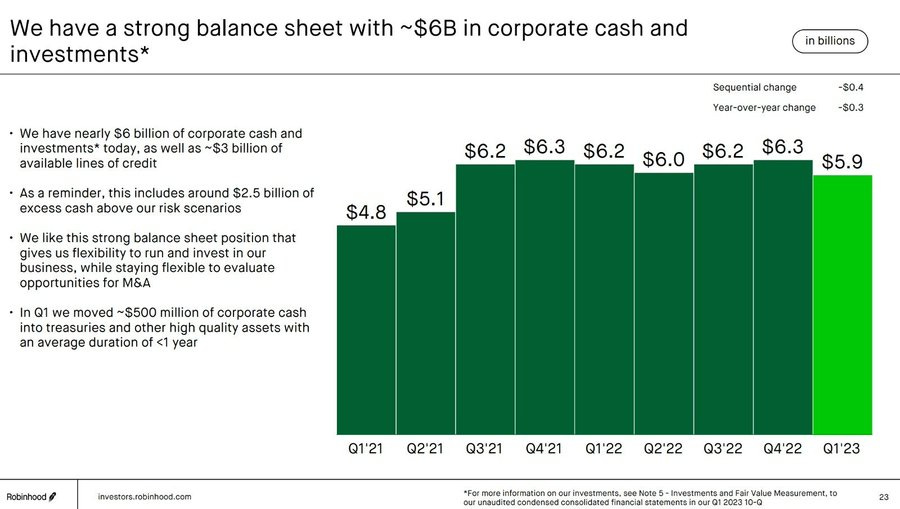

Robinhood has ~$6bn Cash vs ~$8bn Market cap. At the Q1 run-rate, HOOD trades at ~20x EBITDA ex-cash Considering the cash, it trades at ~4x EBITDA.

EBITDA can drastically increase if a volatility event happens, while it can hardly reduce from here.

I consider this a substantial margin of safety.

Conclusion

Robinhood is showing resiliency despite the hate after the GME saga and adverse conditions for its business model. The current price is fair even assuming bad conditions persist, but can explode in the case of a volatility event.

Given the above, I started a small position in Robinhood.

Yours,

Arny

THIS IS NOT FINANCIAL ADVICE