Editor: Emanuele Marabella

Airbnb is the Big Tech of Travel everyone sleeps on it.

Investors fail to recognize its inevitable growth trip has just begun, making the $145 price an asymmetric opportunity.

In this article, I’ll share my Airbnb ABNB 0.00%↑ thesis in a few charts.

Please hit the ❤️ button if you enjoy today’s article. Even Brian Chesky, Airbnb CEO, liked it!

Dead money or massive opportunity?

Airbnb was one of the most anticipated IPOs of 2020, but since the stock price has gone nowhere.

ABNB underperformed the S&P500 by ~50% since IPO.

Is this a trip to “Dead Money” or “Alpha Land?”

No super investor seems to be appealed by the stock since 2021.

The only big institutional investor seriously in the stock is Polen Capital, which bought ~13mn shares in 2021 at $160 and gradually reduced as the stock went down…

Is the world missing one of the best companies of the decade?

Taking market share from giants

Airbnb is gradually taking market share from the two titans of online travel.

Revenue 5y CAGR:

Airbnb: +25%;

Booking: +9%;

Expedia: +4%.

Despite the outstanding growth, Airbnb’s trip has just started.

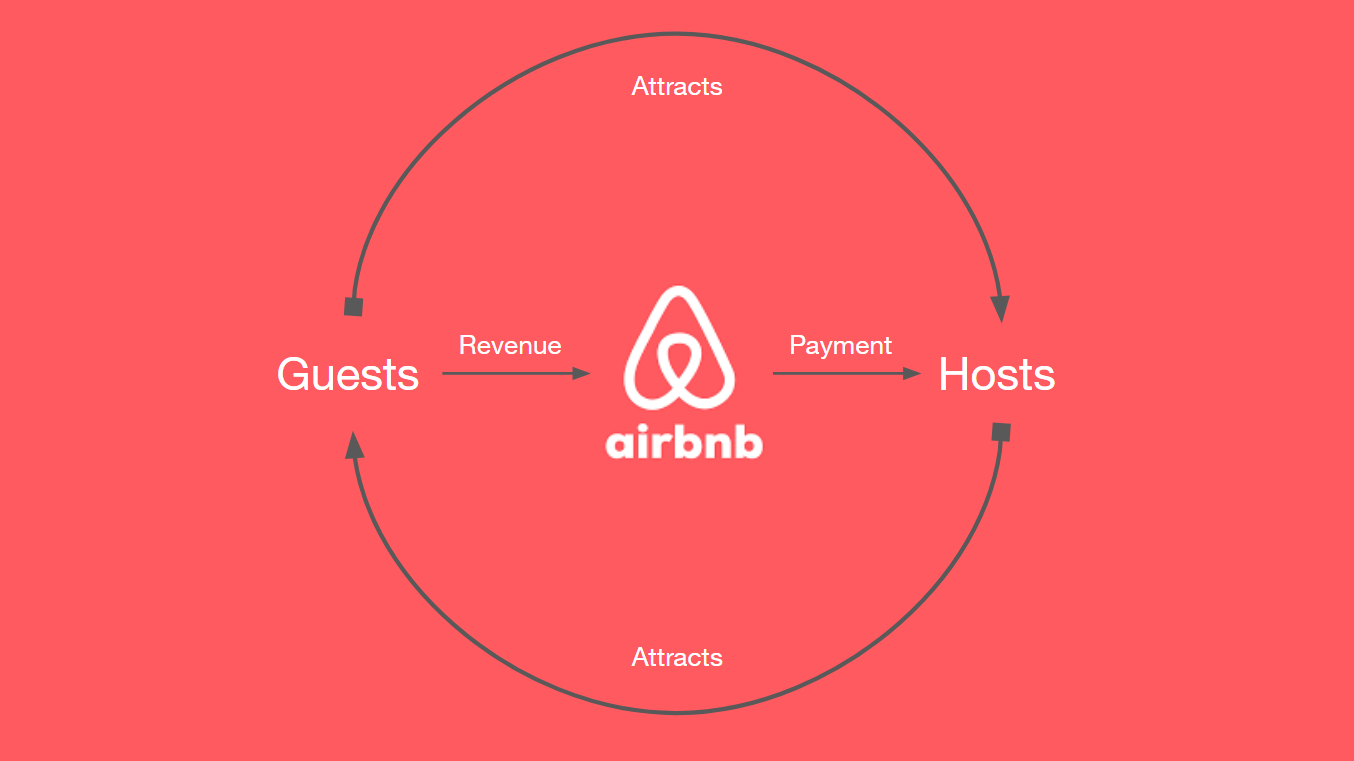

Airbnb is a double-sided network between hosts listing their accommodation on the platform and guests.

As the network grows, it becomes more valuable:

More hosts = users get more value in terms of price and selection;

More guests = hosts have more monetization opportunities.

As the “manager of the network,” Airbnb seeks to maximize the matches between hosts and guests.

Airbnb gets a “cut” of the booking, partly paid by the host and the other by the guest.

On a $100 booking per night ($116 after taxes and fees), Airbnb receives:

$3 from the host;

$12 from the guest.

Therefore Airbnb takes ~15% of Booking Value as Revenues.

Airbnb was born in 2007 with modest funds and was later incubated by Y Combinator in 2009, which helped it scale.

Currently, the Airbnb network counts:

+7mn active listings;

+5mn hosts;

+150mn users;

+450mn Nights and Experiences Booked per year;

+$75bn Gross Booking Value per year.

When a network finds market fit, the growth is explosive and defies gravity.

Winner takes all

The biggest double-sided networks have insane economics.

To have an idea of how much room for EBIT Margin upside compare:

Meta Family of Apps: ~50%;

Visa: ~67%;

Booking: ~29%;

Airbnb: ~16%.

After having touched a near-death experience during Covid, Airbnb has been firing on all cylinders:

Notice: no big tech can attack Airbnb’s moat because building a network of +7mn listings requires a dedicated focus on convincing hosts and more than just financial resources.

Users naturally go to the platform that provides more listings, more value, better experience;

Hosts will post their listings on the platform with the most audience.

Airbnb network is the clear winner of this winner-take-all-all dynamic.

Exclusive network

Despite some hosts increasingly listing their accommodations also on Booking, Airbnb remains the platform with the highest % of exclusive listings.

This trend mainly relates to professional hosts rather than non-professional ones, which are the soul of Airbnb’s offerings.

How can Airbnb prevent Booking from taking further listing shares?

Airbnb answered with Icons.

Icones are a new exclusive category of experiences hosted by the greatest names in music, film, television, art, and sports:

Most Icons are free, and all are priced under $100. The immediate goal is not to maximize revenues but to create a magic, unique experience experience.

In other words, Icons have an insane potential for:

advertising: direct way to connect brands with superfans.

marketing: the Barbie Dreamhouse got more coverage than the company’s IPO.

community: imagine developing a Barbie World…

Preferences are clear

Airbnb is the preferred choice of the younger generations.

~45% and ~24% of US Airbnb customers are Millennials and GenX, respectively.

As the younger generations become wealthier they will travel more and increase their budgets.

Airbnb needs to remain the go-to platform for them. Icons will help achieve that.

The trip has just started

Airbnb Revenue grew by ~17% YoY in Q1:

Developed regions (USA, EMEA) at 9-23%. Key regions like Germany and Switzerland are still untapped;

Developing regions (Asia Pacific, Latin America) at 26-30%. India seems to be the key focus for the management.

The potential is still largely untapped.

India: beating the home leader

Airbnb is rapidly acquiring influence in India, outpacing local competitors like Oyo Rooms and MakeMyTrip, the market leader, and the giant Booking.com.

Travel demand grows as GDP grows.

Therefore, Airbnb can surf the development of the country.

In 2022 Airbnb:

contributed ~$920mn to the Indian GDP and supported over 85,000 jobs;

guests spent ~$815mn, more than double the 2019 levels.

Huge optionality to grow

On top of the growth from the core business, Airbnb has a huge optionality to sustain growth at scale:

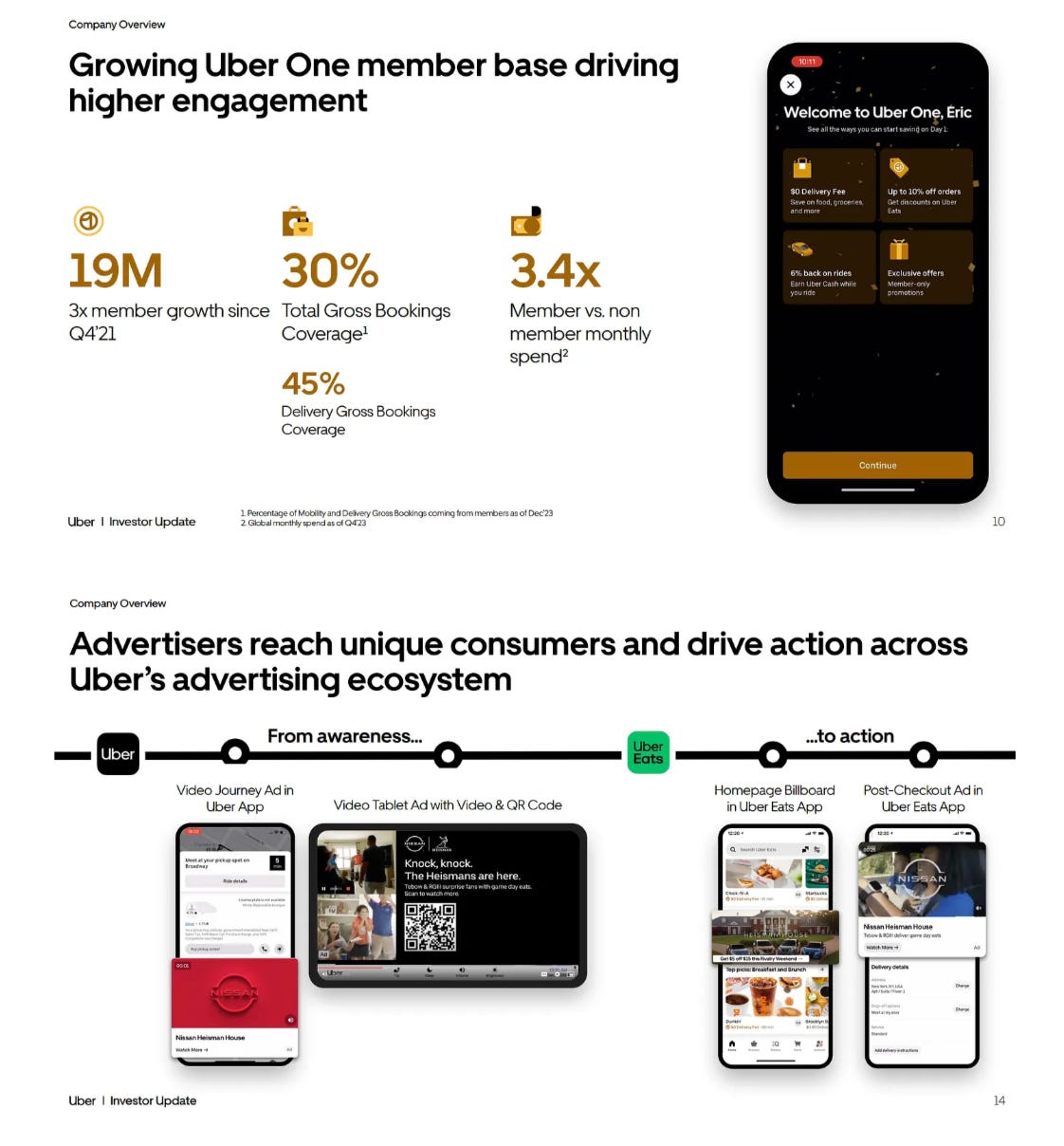

advertising (Uber Eats);

subscriptions (Uber One);

integration with flights (Booking)

group experiences (TripAdvisor);

community experiences (Barbie World).

Float: pay me now, I’ll pay you later

When guests book a room/house:

Airbnb receives the money instantly;

Airbnb pays hosts only at check-in.

In the waiting, Airbnb collects Net Interest from this cash (30-60 days).

The aggregate of the ~$8bn Airbnb holds on behalf of customers is called “float.”

This dynamic allows ABNB to generate:

+100% of EBITDA conversion into FCF (paid in advance);

~41% FCF margin (float = negative delta NWC);

~$110mn/y additional Net Interest risk-free.

Airbnb Bank?

Thanks to the strong FCF generation, Airbnb reached a fortress balance sheet with $11bn Net Cash.

This cash pile, combined with the float is mainly invested in Treasuries, which allow Airbnb to generate a staggering ~$800mn/year risk in Net Interest.

Such a robust inflow allows Airbnb to benefit from periods of high interest rates.

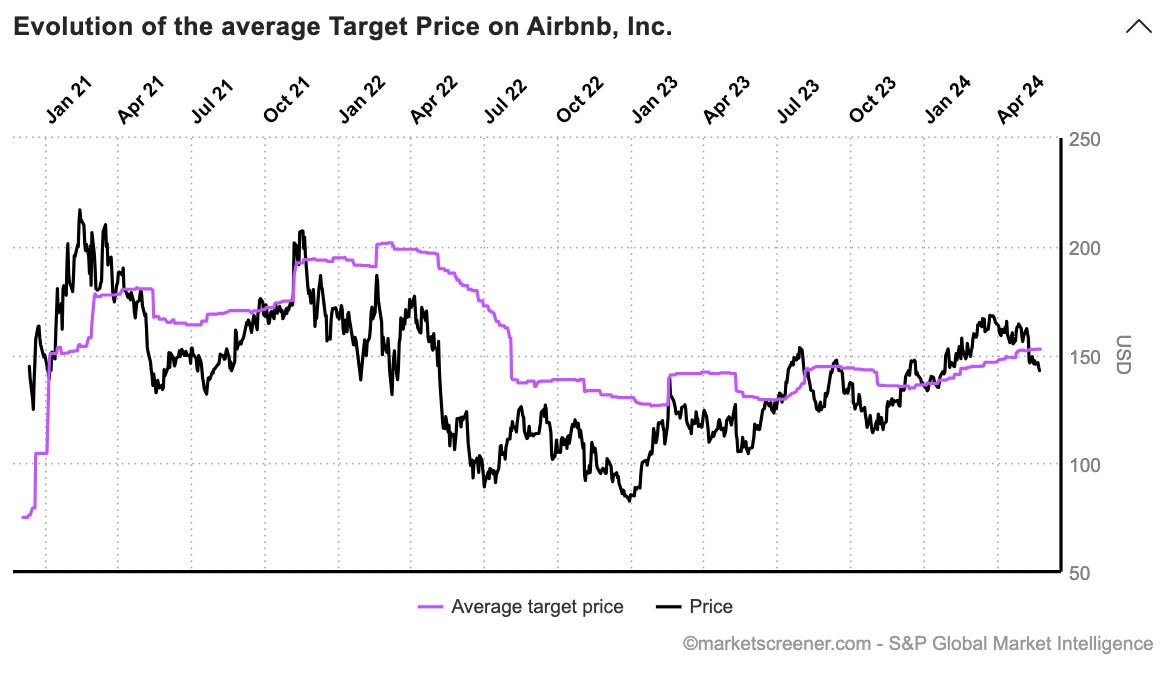

Worth less than 3 years ago

The price is slightly below analysts’ target estimates of ~$150 per share.

Analysts preferred ABNB more when it lost money during COVID rather than now printing money at a +40% FCF margin.

Insanity?

Airbnb currently trades at:

~20x EV/EBITDA (~FCF);

~30x PE.

I consider this valuation very appealing for the emerging leader a winner-take-all market, which can grow at ~15/20% Revenue while expanding margins and enjoying superior economics.

A more fair valuation should be in the ~30x EV/EBITDA, 40x PE range.

Airbnb vs Booking

Since listing Airbnb has been trading at ~25% premium over the rival Booking on all metrics.

I consider the premium deserved since Airbnb has:

superior unit economics: Revenue per Employee of $1.4bn vs $900mn of Booking. This is getting closer and closer to those of the big tech companies.

better brand (“Airbnb” is a noun and verb!);

more optionality (Airbnb is not involved in booking flights yet);

less dependence on advertising while growing more: Airbnb spends ~20% of Revenues on Sales & Marketing, while Booking ~50% and grows less. How relevant Booking would be if it didn’t spend ~$1bn/y on Google?

Some critical data points from the Q1 earnings call:

~90% of Airbnb users come from organic traffic;

+60% YoY Airbnb app downloads in Q1;

+21% YoY Bookings through the mobile app, now 54% of the total nights.

In other words, Airbnb is growing virally.

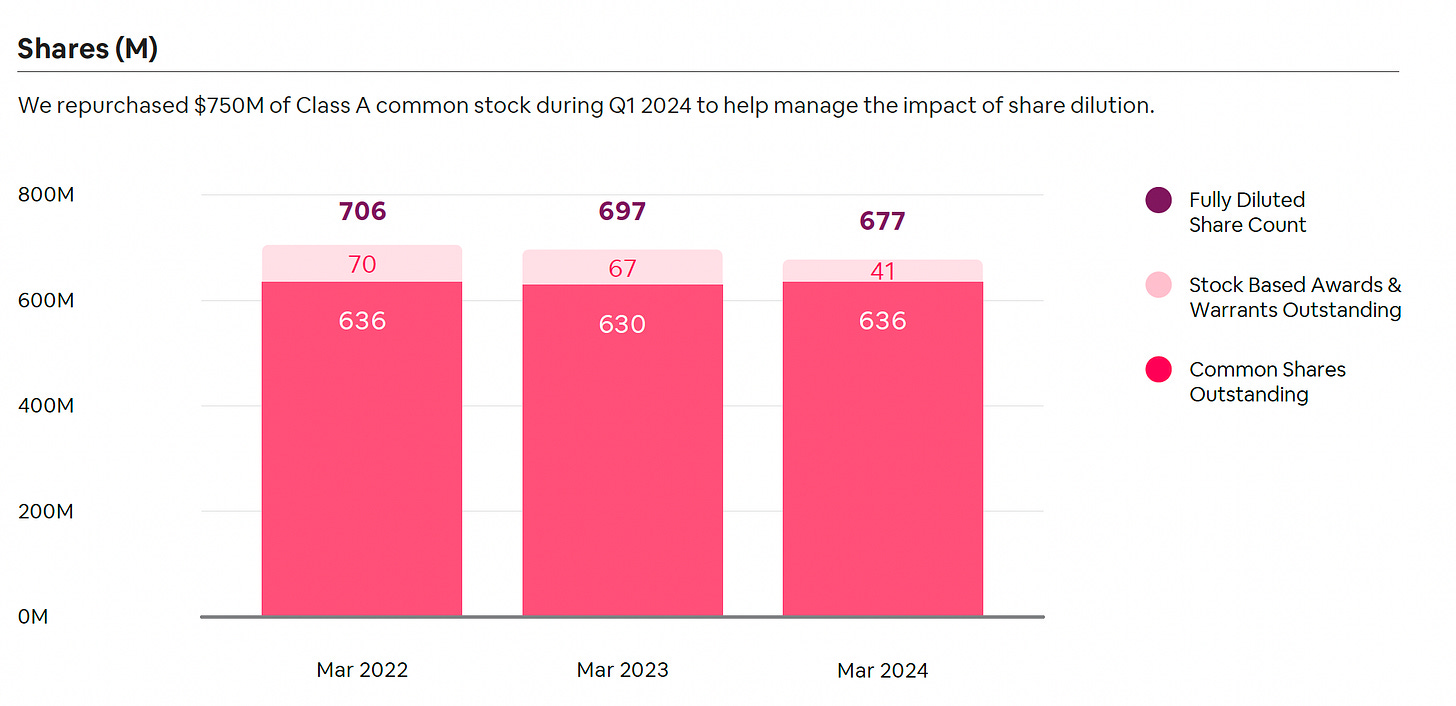

Buyback me more

Both Airbnb and Booking are buybacking aggressively. This is a hint that both companies could be deeply underappreciated.

In the last twelve months, Airbnb repurchased $3.7bn of shares vs $4.2bn Operating FCF.

Furthermore last quarter, Airbnb issued a huge new buyback plan of $6bn, which is more than the 2x the one they just completed.

The entity of this buyback should help provide a floor to the stock and offset the impact of share dilution.

$245 by September or nothing

Airbnb CEO Brian Chesky, a visionary and world-class leader, has a strong incentive to perform.

Since 2020, he has received a salary of $1 but a significant RSU package at the achievement of substantial Stock Price Hurdles.

The 2024 milestone requires a 70% upside from here for 60 days. If the stock doesn’t reach $245 from September he would not receive any compensation (apart from the $1).

Brutal!

The last milestone requires the stock to be at $485 by Nov 30, which requires a 22% CAGR from the current price.

Regulation worries

Regulation is one of the most common risks underscored by Airbnb opponents.

Worried about dramatic increases in rent prices that push citizens outside the key city centers, some cities have restricted hosts’ ability to Airbnb their houses.

For instance: New York in Sep 2023, restricted the ability of hosts to list their homes for stays of less than 30 days.

Since implemented Airbnb saw:

more hosts listing their homes for more than 30 days

acceleration of YoY growth in nights booked for long-term stays;

greater increase in bookings in surrounding areas.

Meanwhile, Hotel prices have increased while rental prices have not decreased.

In other words, regulation risk is more headline than substance:

Not one lone city accounts for more than ~2% of Airbnb Revenue.

Please hit the ❤️ button if you enjoy today’s article and share it!

Conclusion

While customers love Airbnb, institutional investors are sleeping on one of the best trips of the decade.

I just booked a trip to Alpha Land.

Reach me:

Disclaimer: The views and opinions expressed above are current as of the date of this document and are subject to change without notice. Materials referenced above will be provided for educational purposes only. None of the above will include investment advice, a recommendation or an offer to sell, or a solicitation of an offer to buy, any securities or investment products

Great article, thanks! I've been in since under $100, it seemed like a complete no brainer. I hope they continue to perform!

Extremely valuable analysis, thank you Arny Trezzi !