Editor: Emanuele Marabella

MSCI 0.00%↑ is a money printing machine generating high-margin recurring Revenue in whatever market condition.

The current price of ~$500 does not reflect the strength of the fundamentals, which benefit from the inevitable growth of financial markets and thrive amid volatile conditions, creating an asymmetric opportunity.

An oligopoly with superior financials and proven capital allocation ability. What else?

In this article, I’ll explain my MSCI thesis in a few charts.

PRRRRRRR

MSCI is simply a compounding beast:

12% Revenue CAGR;

45% FCF Margin;

20% EPS CAGR.

Growth has been relentless despite market conditions and geopolitical events.

These numbers have allowed MSCI to kill the S&P500 in the past decade:

How did MSCI succeed?

Please hit the ❤️ button if you enjoy today’s article and share it!

The Index Gatekeeper

The index industry is heavily concentrated and MSCI dominates it with a ~25% market share.

S&P 500 Dow Jones (25% market share) and FTSE Russell (21%) are divisions of the diversified groups S&P Global and London Stock Exchange, respectively.

MSCI is the only player in the oligopoly with a core focus on indexes.

What’s an Index?

A market index is a weighted list of stocks/bonds, periodically rebalanced.

Indexes could be considered “recipes” or “model portfolios” allowing investors to obtain exposure to a certain industry, geography, or particular investment theme, like ESG or Value Small Caps. Indexes can be created on potentially any category of the financial market.

This means that demand for new indexes naturally emerges to capture new interests.

Clients pay MSCI to receive these updated indexes as “benchmarks” to build and track investment portfolios/funds. Therefore indexes are critical for the efficient functioning of the financial markets.

For example, below are the top constituents of the S&P500 index, the most famous index and reference for the US stock market:

In the same way, MSCI is becoming the reference for World, Emerging Markets, and China ETFs/Funds:

Index as a Service

MSCI financial numbers are not only exceptional but also of the highest quality:

97% of revenues are recurring, providing protection during downturns.

More in detail:

74% of Revenues are from fixed subscriptions, mainly Index and ESG related. MSCI essentially sells “Indexes as a Service.”

21% of Revenues are from Asset Based Fees, which entitle MSCI to receive a % (~2.5bps) of the Asset Under Management (“AuM”) linked to its indexes.

MSCI always wins

MSCI business is set to succeed in any environment:

Markets up? MSCI benefits from higher asset-based fees and can support EPS by tactically rolling debt at favorable rates given its investment grade status.

Markets in distress? The headwind on asset-based fees is offset by subscription revenues on risk-oriented products and exploits market volatility with share repurchases.

Growth at $0 cost

Asset Based Fees allow MSCI to defy gravity.

MSCI clients spend on marketing to expand their asset base by raising funds and then work to make their portfolio perform. By taking a % on a higher AuM, MSCI collects more fees without spending additional money to generate that incremental Revenue.

MSCI collects a royalty on the growth of its clients.

Warren Buffett shared his appreciation for businesses with this ability in a 1997 email exchange on Microsoft. Thank you

for sharing.“The best business is a royalty on the growth of others, requiring little capital itself.” – Warren Buffett

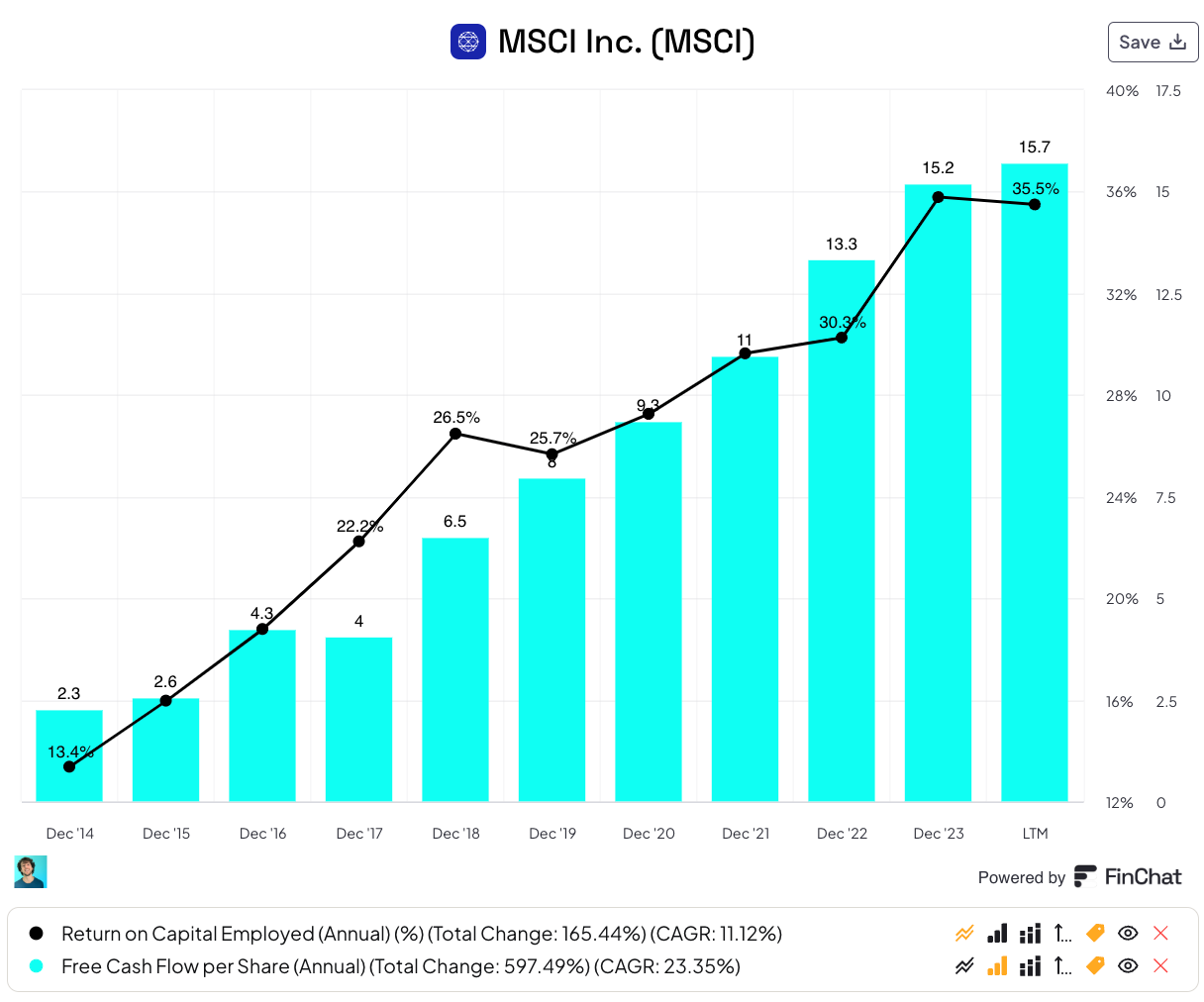

This dynamic, combined with a light capital business (~$0 Capex), allows MSCI to reach a stunning ~35% Return on Invested Capital.

NB: differently from classical SaaS, MSCI has negligible SBC (~3% of Revenue).

Trusted in chaos

As mentioned in my Robinhood thesis, the most important metric to assess financial companies is whether they are trusted in moments of distress.

ETFs and Funds linked to MSCI Indexes attracted positive Net Inflows every year except 2013.

This dynamic supports the stability and growth of asset-based fees.

We could summarise that MSCI grows as long as:

Clients select MSCI as the index provider to capture new investing themes;

Clients funds acquire new inflows;

Markets naturally rise.

MSCI is a bet on financial markets growing over time, spiced with operating leverage and juicy shareholder buybacks.

Further upside for margins

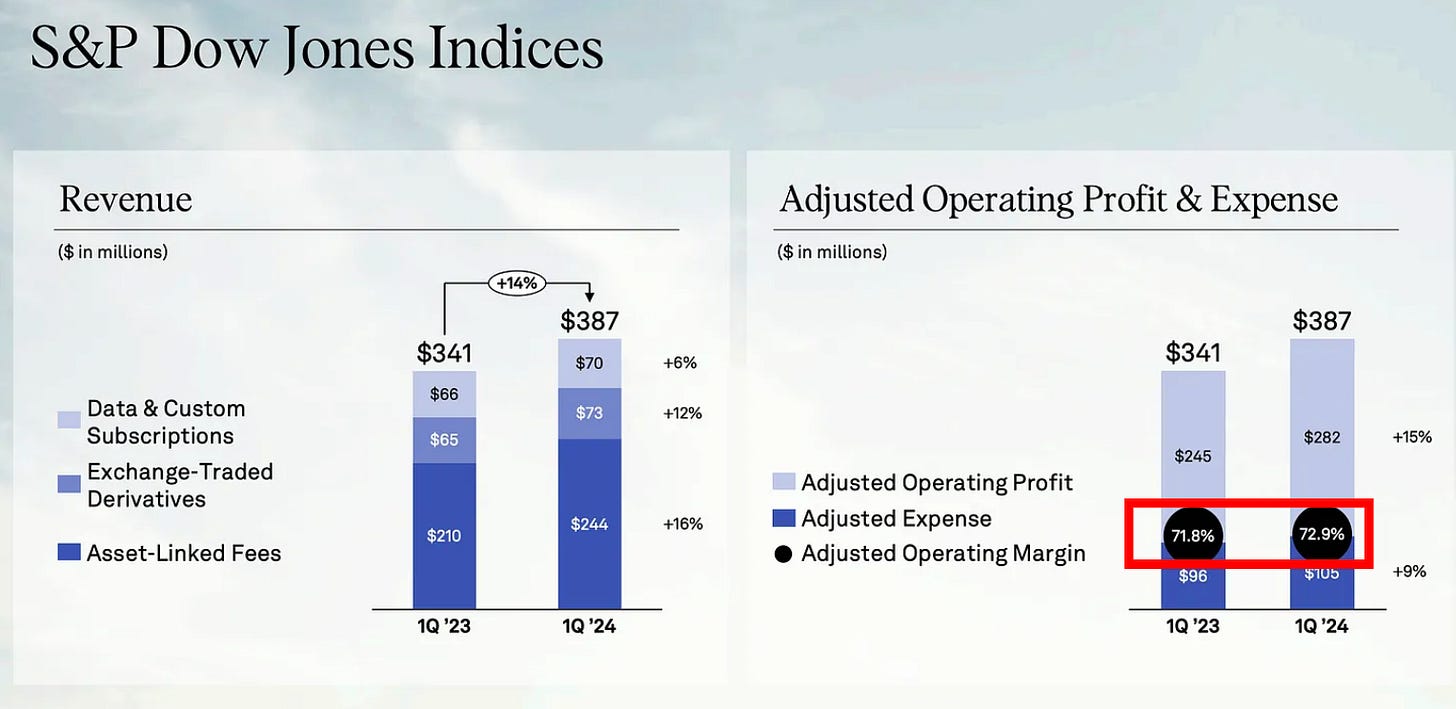

MSCI’s 55% EBIT Margin is very elevated but has further potential upside.

S&P Global’s Index division has ~72% EBIT Margin, hinting that MSCI could gradually approach that as it increases its influence and the AuM related to its funds.

Temporary headwind is not an issue

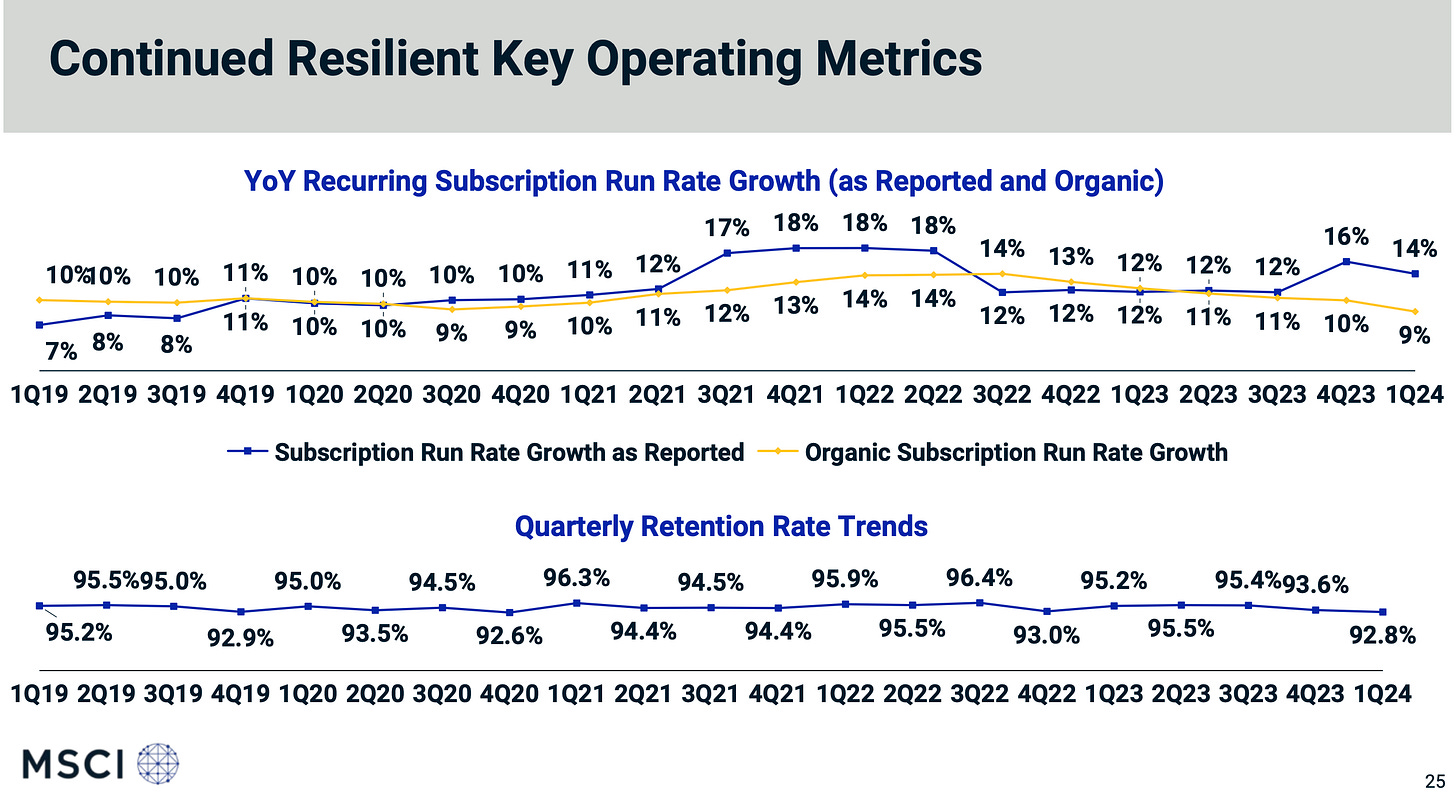

MSCI recently dropped ~20% after its Q1 results mainly due to a lower Retention Rate of 92.8%, the lowest level recorded since 20Q4.

According to the management, the reduction was due to the merger of the two biggest Swiss banks Credit Swisse and UBS which caused a rationalization of costs and a reduction of the amount of indexes purchased.

I consider this a temporary headwind and not a structural problem.

Superior capital allocation skills

MSCI has proven a superior ability to allocate capital efficiently:

Tactically repurchased shares when they traded at an attractive valuation. Shares outstanding decreased ~30% since 2021.

Demonstrated M&A skills in acquiring and integrating smaller competitors and complementary companies to affirm dominance and expand into new verticals. The most recent one is Burgiss, a leader in Real Estate data.

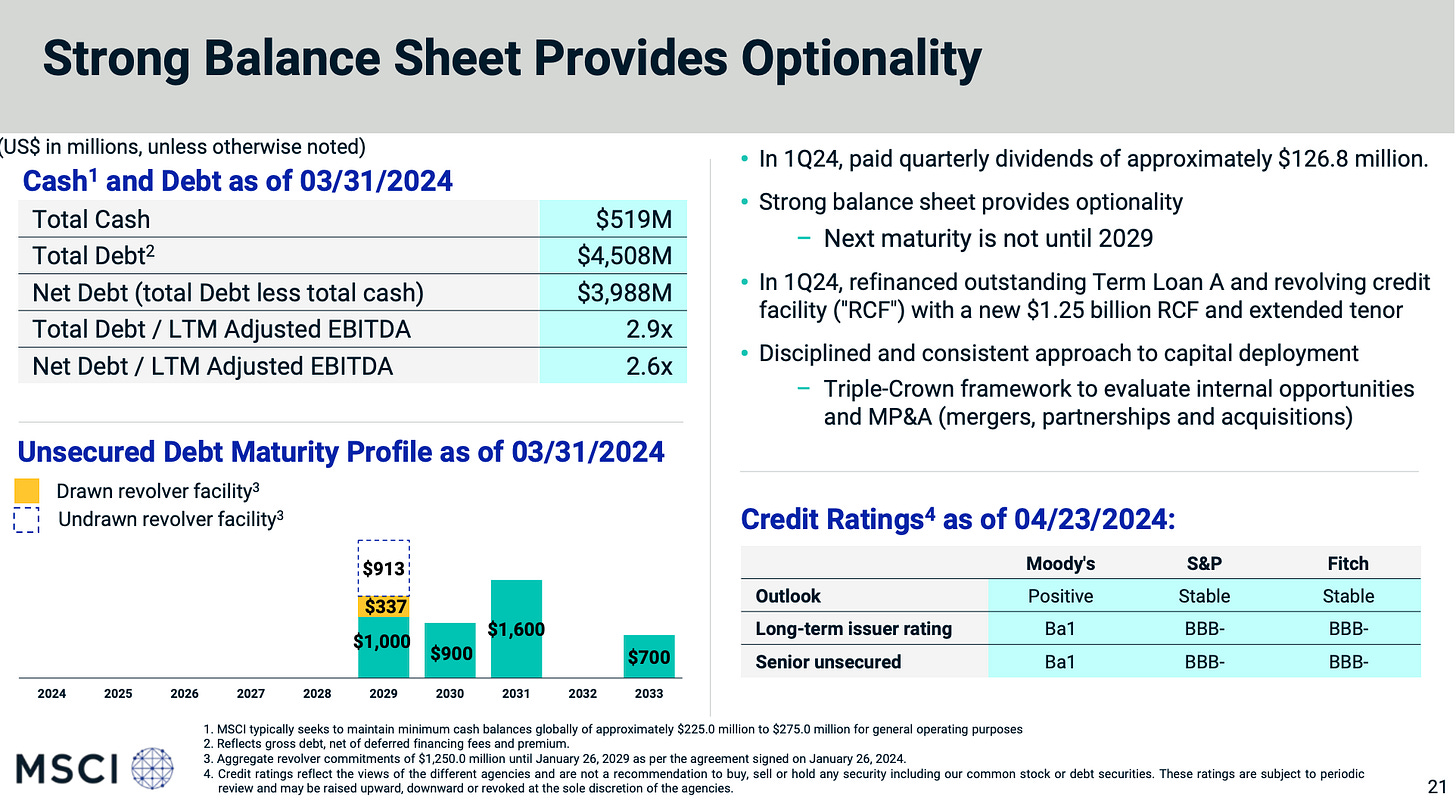

Opportunistically and carefully deployed debt. Net Debt / EBITDA is stable below 3x. Given its investment grade rating, MSCI can easily refinance this debt to support its expansion, M&A, and buyback.

ESG controversy

MSCI was one of the key beneficiaries of the ESG & Climate trends as it provides related ratings and indexes. Interest in ESG & Climate has recently decreased but MSCI’s solutions keep growing supported by an increasingly favourable regulatory environment.

Regulation, which seeks to standardize criteria of ESG & Climate ratings, could “lock in” MSCI’s power, generating the same legitimacy the top 3 credit rating agencies benefit from.

You’ll pay whatever

Indexes are simple products and can be easily replicated.

Yet, building a successful index business is nearly impossible due to the presence of the oligopoly of the incumbents.

When institutional investors create a new fund they are likely to purchase indexes from the top 3 providers and there is little incentive to change:

An established index will facilitate the gathering of new assets. For instance, an “Arny500 ETF” would not sell as good as “S&P500 ETF;”

Institutional investors are unwilling to rewrite their mandates to change benchmarks once fixed;

Deploying analytics services directly from the index providers facilitates performance attribution and portfolio management.

Enhancing the “lock in,” investment funds are heavily discouraged by regulation to use self-index.

Valuation

MSCI is trading at ~25x EV/EBITDA or ~33x PE, which are multi-year lows.

I consider these multiples attractive for a company that structurally can grow its EPS by ~20% while having recurring revenues at high margins and can return substantial cash to shareholders in buybacks and dividends without sacrificing growth.

MSCI is often compared to SPGI and MCO, despite these two being primarily focused on Credit Ratings.

We can see how MSCI has typically traded at a premium vs SPGI and MCO, but not now.

MSCI should deserve a premium vs SPGI and MCO due to:

Higher marginality: ~54% EBIT Margin vs ~40%

Higher growth: ~20% EPS 5y CAGR vs ~5%.

Focus on indexes: the most lucrative segment.

More scalable business: ~$500k Revenue per employee vs ~$350k

Therefore, I believe MSCI should trade in the ~30x EV/EBITDA or ~40x PE ranges (~20% upside).

Even if the multiple appreciation didn’t happen, at the current price, MSCI stock could keep compounding at ~20% CAGR due to the inevitable growth of the financial markets and support from share repurchases.

Buybacks done well

A hint that MSCI is undervalued comes from the company itself. MSCI stock is trading at the price where it repurchased $1.4bn in 2022 and $500mn in 2023.

Given the strong FCF generation, MSCI could deploy $200-300mn per quarter in buyback without compromising its credit rating while continuing to grow.

The intensity of buyback has reduced in the last quarters because the company prioritized M&A (Burgiss).

However, I expect MSCI to return repurchasing aggressively shares as the multiple remains contracted and the business expands.

The Asymmetry

Given the Revenue structure described above, MSCI business heavily benefits from rising global markets, which could be proxied by an MSCI World Equity ETF.

An asymmetry therefore emerges when the World ETF rises, but MSCI drops.

Over the last year:

MSCI +10%;

MSCI World ETF: +24%.

This gap should close.

Further interesting elements:

MSCI offers more than 160,000 indexes;

Insiders (CEO and COO just bought shares for ~$9mn;

MSCI is a spinoff from Morgan Stanley, now 1/3 of the “mother”;

Henry Fernanzed CEO has been leading the company since 1998;

Blackrock is the biggest client at 9.8% of the Revenues (40% of Asset-Based Fees)

Please hit the ❤️ button if you enjoy today’s article and share it!

Conclusion

MSCI is a high-quality compounder that archives superior returns by surfing the inevitable growth of the world financial markets and tactically exploiting turbulences with a combination of M&A and share repurchases.

The current price diverges from the fundamentals, creating an asymmetric situation.

Yours,

Arny

Reach me:

Disclaimer: The views and opinions expressed above are current as of the date of this document and are subject to change without notice. Materials referenced above will be provided for educational purposes only. None of the above will include investment advice, a recommendation or an offer to sell, or a solicitation of an offer to buy, any securities or investment products

Love the company, but hate the price.

Great! Thanks