Editor: Emanuele Marabella.

Virtu at $18 is an asymmetric situation: get paid to hedge from a market crash.

In this article, I’ll explain my VIRT 0.00%↑ thesis in a few charts.

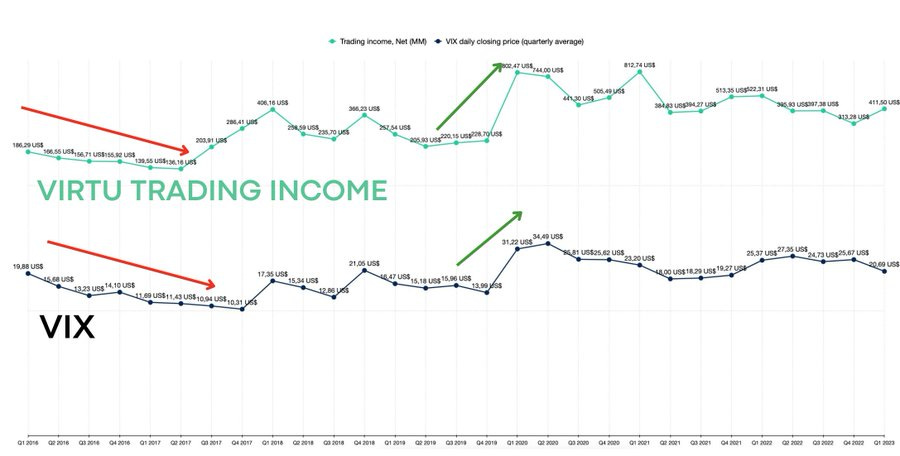

Virtu shines when panic spikes

Virtu is one of the rare companies that raise when the VIX (volatility index) spikes and the market crashes.

How is this possible?

Virtu, as a market maker, supports market liquidity by providing a bid and ask price for securities (mainly US Equity).

It makes money from the spread it is able to capture from people buying and selling.

Virtu makes more money when:

Volume is high;

The bid-Ask spread is high.

Virtu’s dream situations are crashes like in 2020, which presented an appealing combination of high volatility and wide spreads.

As a market maker, Virtu’s role is to always provide a bid and an asking price to facilitate transactions. This means that Virtu doesn't care about the direction of markets: Virtu cares about investors keep trading.

We could synthesize Virtu’s Trading Income by the following conditions:

High VIX = high income;

Low VIX = low income.

Thank you @em013L for the great chart!

Profitable even in the worst conditions

Virtu has a steady ~20% market share of over-the-counter trading, following Citadel.

A peculiar fact is that, according to the S-1 filling, Virtu only had 1 trading day in loss from 2009 to 2014.

Despite the current adverse conditions (VIX extremely low), Virtu still has a ~37% return on capital.

This is a base similar to 2019 when VIX was at similarly low levels. If VIX spiked due to a volatility event, its profitability should spike again (101% return in '20).

Rewarded to hedge

Virtu has a peculiar dividend policy of a fixed $0.24 per share quarterly dividend.

This is ~5% dividend yield at current price.

The excess cash is used in buybacks to shareholders to keep the trading book at ~$2bn since it is easier to make good returns with small capital.

Furthermore, Virtu repurchased ~15% of its shares in 2 years.

At the current rate Virtu has ~5% buyback yield at least.

As we shared previously with Robinhood, forecasts for Virtu don't make sense because numbers can change radically if a volatility event happens.

It is better to reason in terms of min EPS and shareholder yield.

Virtu currently trades at ~8x Last 12 Months EPS, which I consider a "base" and offers:

~5% dividend yield (peak!);

~5% buyback yield at least.

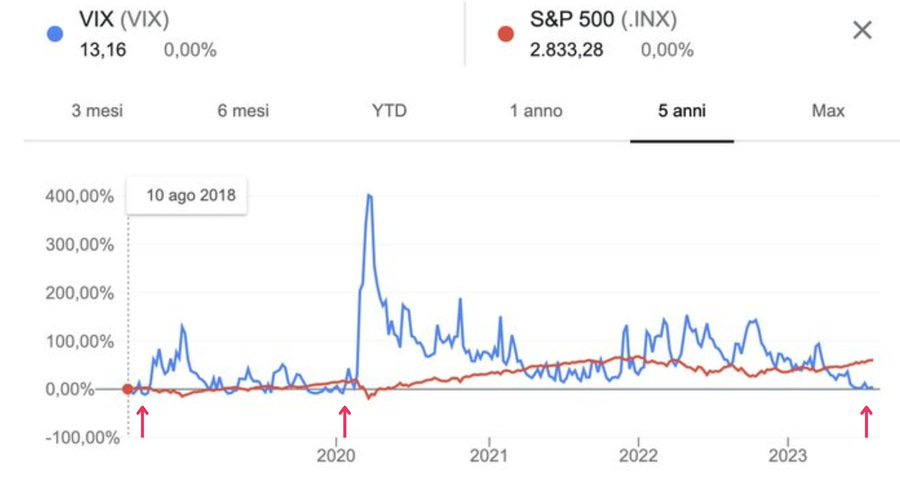

This implies a satisfactory return even if VIX stayed low for a long time. In addition, there is the possibility of an explosive upside if VIX spikes due to a volatility event, like a major financial crisis, war, pandemic etc.

Volatility is for Virtu what the oil price is for oil producers.

Peter Lynch, the legendary investor, explained that cyclicals must be bought when the earnings are depressed, not when the PE seems low due to abnormally high earnings.

Virtu is at the bottom of the volatility cycle and its earnings are currently in the lower range given the market conditions. Therefore I consider the current setting appealing.

Why is Virtu under the radar?

Perception of High-frequency Trading (“HFT”) firms is not positive after the Gamestop saga of 2020 where they were seen as “evil”.

Virtu is considerably smaller than Citadel, which is the most common name in HFT.

Investors often overlook companies with cyclical financials.

The key risks I see for Virtu:

VIX remaining potentially low;

Regulation on payment for order flow;

Growth initiatives (options, block ETF, crypto) may not be able to scale at the same level as the core business in equity

Debt could become an issue if Virtu will not be able to stay extremely profitable.

SEC adversity: Virtu just received a Wells Notice for presumed access to post-trade data from Jan’18 to Apr’19. Virtu voluntarily told the regulator about the issue three years ago, but officials hadn’t found evidence that data was improperly accessed.

Please hit the ❤️ button if you enjoy today’s article and share it!

Conclusion

Virtu is a company that could be considered a hedge against disasters.

In other words, being long Virtu is similar to being long volatility, but being paid in the waiting rather than paying the derivative premiums.

Hedge when insurance is cheap, not when you need it

Given the above, I started a small position in Virtu.

Yours,

Arny

THIS IS NOT FINANCIAL ADVICE

Thank you very much. I didn't know about this company )

great take ... I like a lot this kind of risk/return propositions ... cheers!