Editor: Emanuele Marabella.

Tradeweb is a compounding beast eating market share in an inevitable trend in financial markets.

The current price of ~$73 does not reflect the strength of the fundamentals, which thrive amid volatile markets, creating an asymmetric opportunity.

In this article, I’ll explain my TW 0.00%↑ thesis in a few charts.

STOP phone calls

35-40% of the US Treasury trading happens on voice calls.

Many fund managers still make calls to brokers rather than a few clicks on a platform like retails do on Robinhood (I’ve seen it!). This is clearly inefficient.

Tradeweb offers a leading electronic platform to facilitate institutional bond trading.

The Fixed Income Market ("bonds") is catching up with electrification:

~75% of Equity trading is done electronically vs ~60% in Fixed Income.

This is an immense opportunity for leading Fixed Income platforms like Tradeweb.

High growth - high margins. What else?

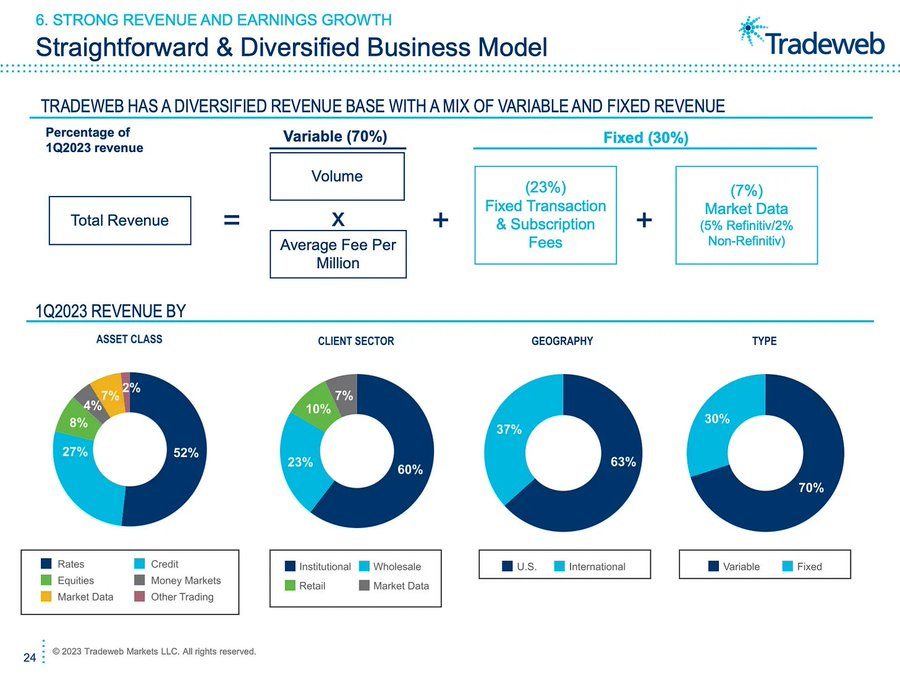

Tradingweb as a trading platform, derives 70% of its revenues as a % "bite" of the transacted volume.

As a consequence, Tradeweb makes more money when investors trade more or increase the size of their bond portfolios.

Revenues grow at ~0% marginal cost. TW has no trading risk. It needs to keep users.

Tradeweb is taking market share in the US Treasury trading market:

20% of US Treasury trading is facilitated by Tradeweb

This segment represents ~56% of Revenues, followed by Credits (Corporate Bonds) where Tradeweb has ~15% share, which keeps growing!

Tradeweb is taking market share by growing 2x the market.

As the bond market naturally grows, TAM for Tradeweb increases. Tradeweb doesn't care where bond yields go as a result of market expectations, it cares about fund managers increasing their trading activity, which is expected to increase thanks to an increasing interest in bond ETFs.

Blackrock, the world’s biggest asset manager, reported that Fixed Income ETF assets are going to triple by 2030. This is clearly a strong tailwind for Tradeweb.

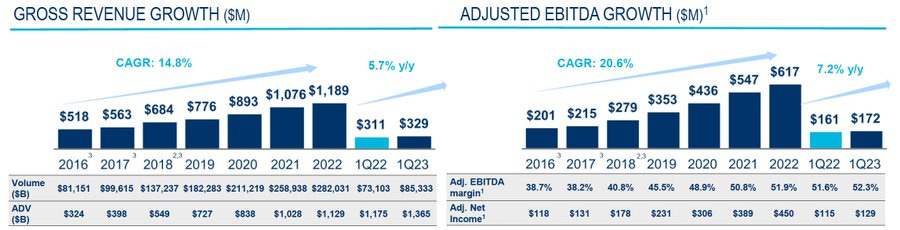

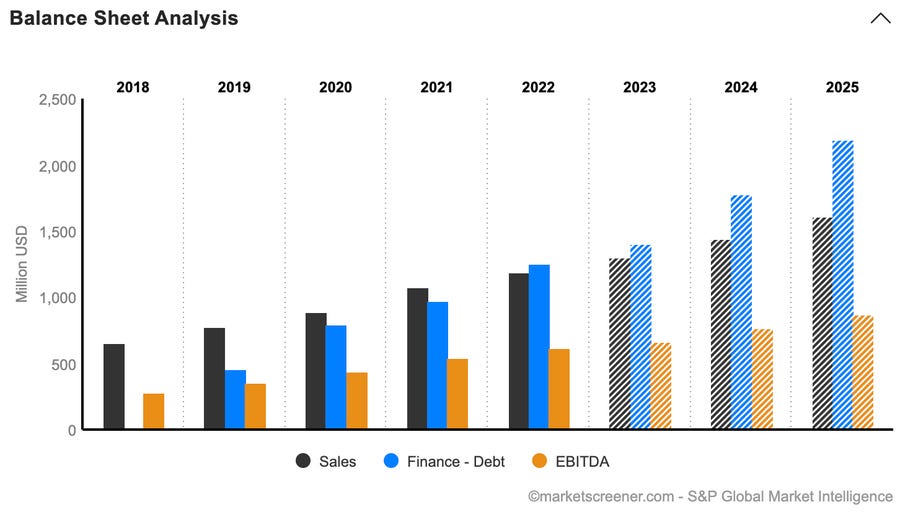

Tradeweb is a money printing machine with EBITDA growing at ~20% CAGR while having a staggering ~50% EBITDA margin.

Margins keep growing as existing clients trade more and with bigger amounts. This means that the marginal cost of growth is minimal.

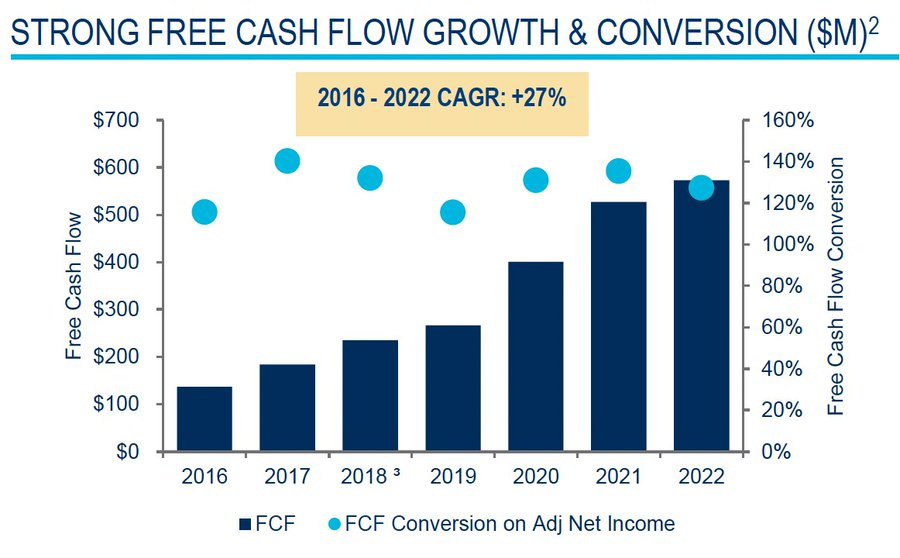

Tradeweb sustains a ~50% FCF margin at 27% CAGR thanks to its minimal capital requirements.

NB: FCF is higher than Net Income due to high D&A (pushdown accounting to the Refinitiv Transaction). Therefore, FCF multiples are more significant than Earnings ones.

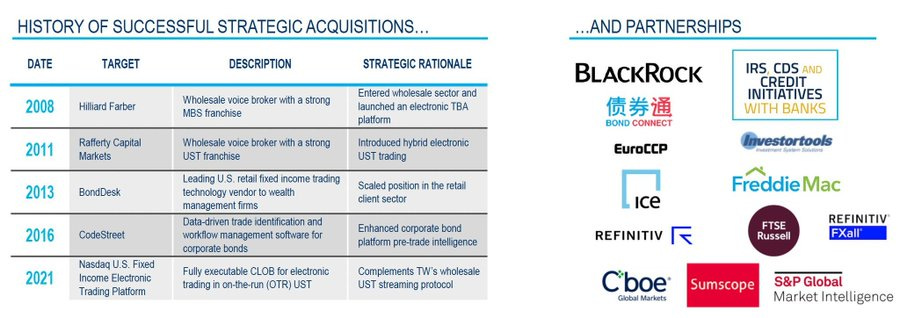

These numbers can be maintained thanks to the broad network of clients, which involves the most important institutions like Blackrock, S&P Global, Citadel.

Tradeweb also exhibited a strong capacity of performing M&A deals.

Market volatility? Yes please.

Tradeweb is antifragile to market volatility:

When fear spikes, investors trade more, which means more trading fees.

During the COVID crash, Tradeweb’s stock had only ~25% drawdown and rapidly recovered thereafter supported by the spike in trading activity which boosted growth.

Currently, Tradeweb is ~27% below its all-time high.

Tradeweb trades at ~25x EV/FCF, which is cheap for a secular compound growing at 27% CAGR with high margins and ~0 investment requirements.

NB:

SBC is 1% of Revenue;

High D&A is mainly due to Refinitiv Transaction (no business impact);

Margins keep expanding.

Furthermore, Tradeweb has a $1.2bn Net Cash fortress.

This means plenty of room for further dividends and buyback as the operating business requires minimal capital requirements to sustain its growth.

Tradeweb’s financial numbers are similar to those of MSCI, which is a top-notch quality company trading at ~30x EV/FCF (now low) while having a comparable FCF margin and growth profile. Therefore;

Tradeweb could easily trade at ~30/40x FCF.

Even if the multiple appreciation didn’t happen, at the current price, Tradeweb stock could keep compounding at 20-30% CAGR following the business growth, which, as we mentioned, is supported by a leading position in a secular trend.

The key risks I see for Tradeweb:

the company is controlled by Refinitiv, a financial data company owned by the London Stock Exchange, which controls 90% of the voting power. This could create a potential conflict of interest;

high margin businesses attract competition. Therefore, consolidating the leadership position and becoming the standard is the key;

the low volatility regime could continue creating a headwind for future growth as investors are less incentivized to trade bonds.

Please hit the ❤️ button if you enjoy today’s article and share it!

Conclusion

Tradeweb is a high-quality compounder eating a bigger size of a pie, naturally expanding.

The current price is appealing even without multiple reevaluations (~25x FCF vs ~27% FCF CAGR) and there is untapped potential for dividends and buybacks.

Given the above, I started a small position in Tradeweb.

Yours,

Arny

THIS IS NOT FINANCIAL ADVICE

@arny_trezzi @laorca_capital

What a great job! Expressing my sincere gratitude for the thorough explanation you provided about $TW

Your insights are incredibly helpful and greatly enhanced my understanding of $TW

Grazie for taking the time to share

Thank you Arny!!