Editor: Emanuele Marabella

Apollo Global Management is the dominant investor in private credit.

The current $150 price does not reflect the perfectly synergic engine that makes Apollo a generational compounder capable of reshaping the financial industry.

Titanic things happen when you combine a terrific asset allocator with a never-ending stream of capital.

This is Berkshire 2.0.

In this article, I’ll explain my APO 0.00%↑ thesis in a few charts.

Please hit the ❤️ button if you enjoy today’s article!

Alpha generates alpha

Apollo Global Management is a leading financial company that destroyed the S&P500 after it became listed in the aftermath of the Great Financial Crisis.

While the past results are extraordinary, Apollo’s maniacally integrated business allows this outperformance to expand further.

Warren Buffett’s Berkshire became the world’s top investor by exploiting the power of “free money” float from insurance operations and deploying it into high-return opportunities.

Apollo takes that idea one step further, creating an engine that structurally manufactures superior risk-adjusted returns for itself and its clients.

As a result, Apollo has over $700bn in Assets Under Management (“AUM”) and generated over $4.5bn in Net Income as of FY24.

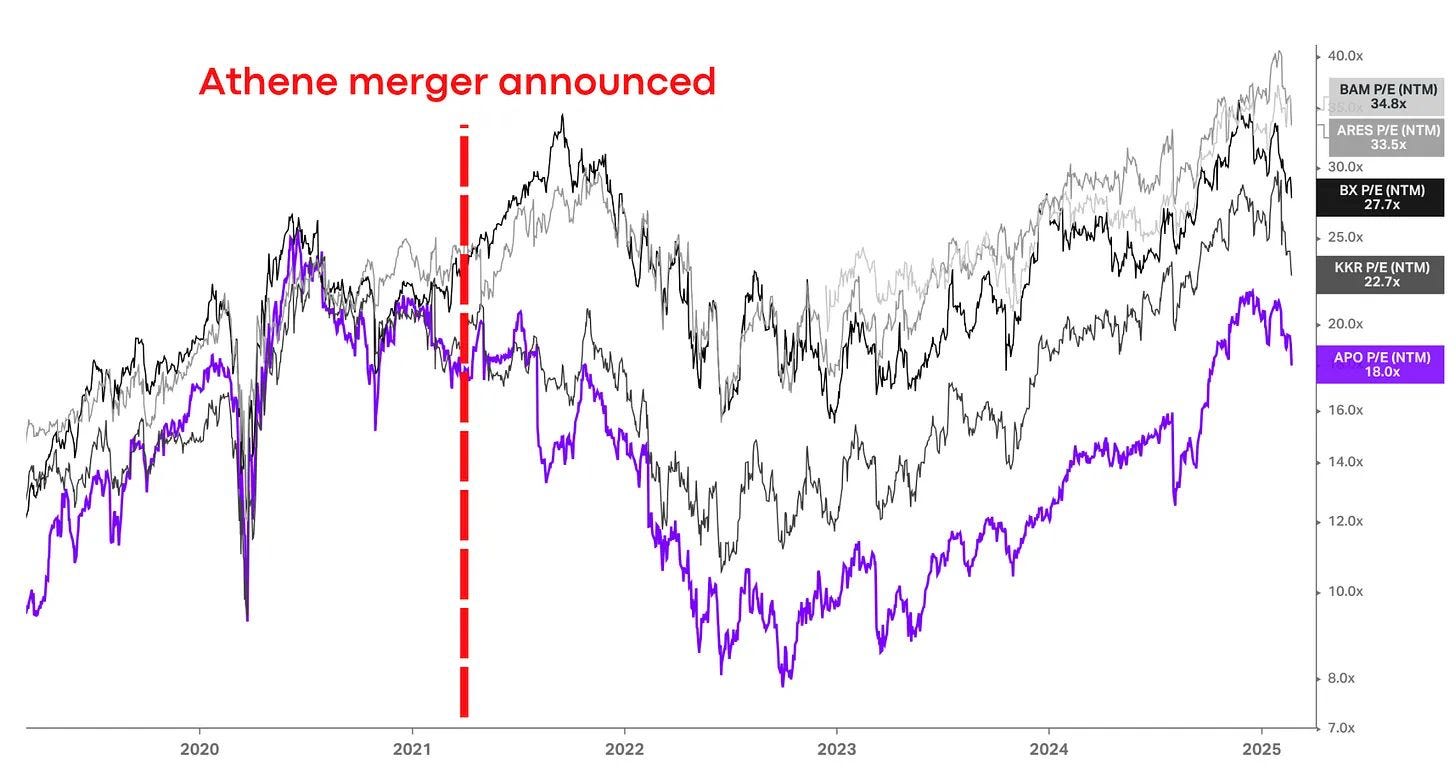

Despite its stellar performance, Apollo has been substantially cheaper than its competitors on a PE basis since it announced the acquisition of Athene, a Retirement Solution provider.

Markets believe that Athene contributes negatively to the value of the merged entity due to its asset-heavy nature.

In reality, Athene makes Apollo’s capital-light business solidify its competitive advantage and set it for structural dominance.

Let’s assess why.

When two gods combine

Apollo Global Management represents the perfect combination of two winning souls:

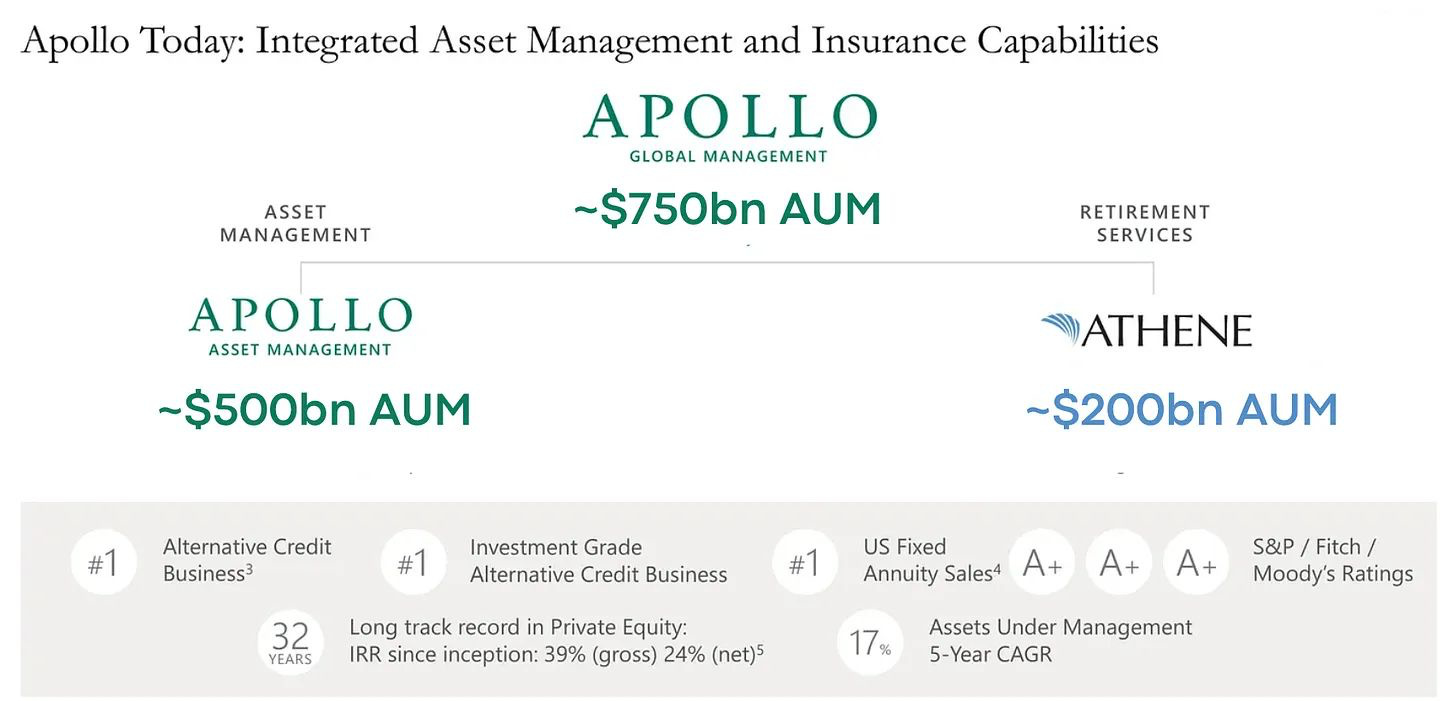

Athene (~$500bn AUM): the #1 Retirement Solution provider;

Apollo AM (~$200bn AUM): the #1 Alternative Asset Manager in Credit.

Apollo AM co-founded Athene in 2009 and has maintained a ~30% stake while supporting its mutual growth.

In 2023, they merged and created Apollo Global Management, the combined entity that manages over $700bn Assets Under Management (AuM) and is set to dominate the private credit industry.

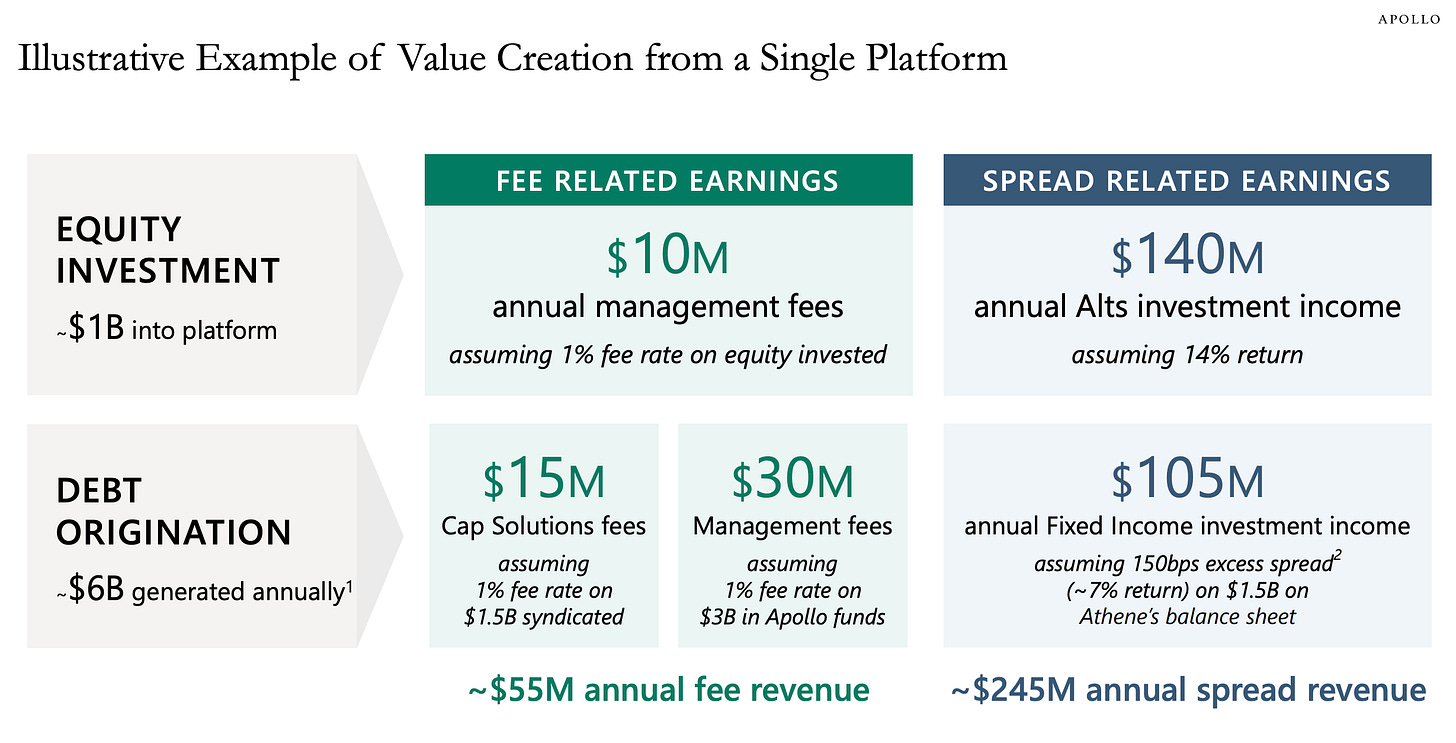

Apollo Global generates earnings from three sources:

~60% from Spread-Related Earnings (“SRE”): Athene receives money from its annuity clients and reinvests them into assets with ~1.5-2% higher yields while keeping the difference. Apollo AM manages this capital;

~35% from Fee-Related Earnings (“FRE”): Apollo AM is paid ~1.5-2% of the assets to manage third-party capital, mainly other institutional investors like pension funds, through its funds;

~5% from Principal Investing Income (“PII”): Apollo AM receives a 15-20% performance fee called “carried interest” for the overperformance of its funds.

These earnings are extremely synergic: the success of one feeds the other and vice versa, creating the basis to sustain strong growth at scale.

Higher for longer? Great

Thanks to its ability to source deals, Apollo has grown substantially even in a low-rate environment, but its nature benefits from a “higher for longer” regime.

With higher rates, Athene’s annuities and Apollo AM’s funds can yield better returns for clients, stimulating more inflows that feed Apollo’s flywheel.

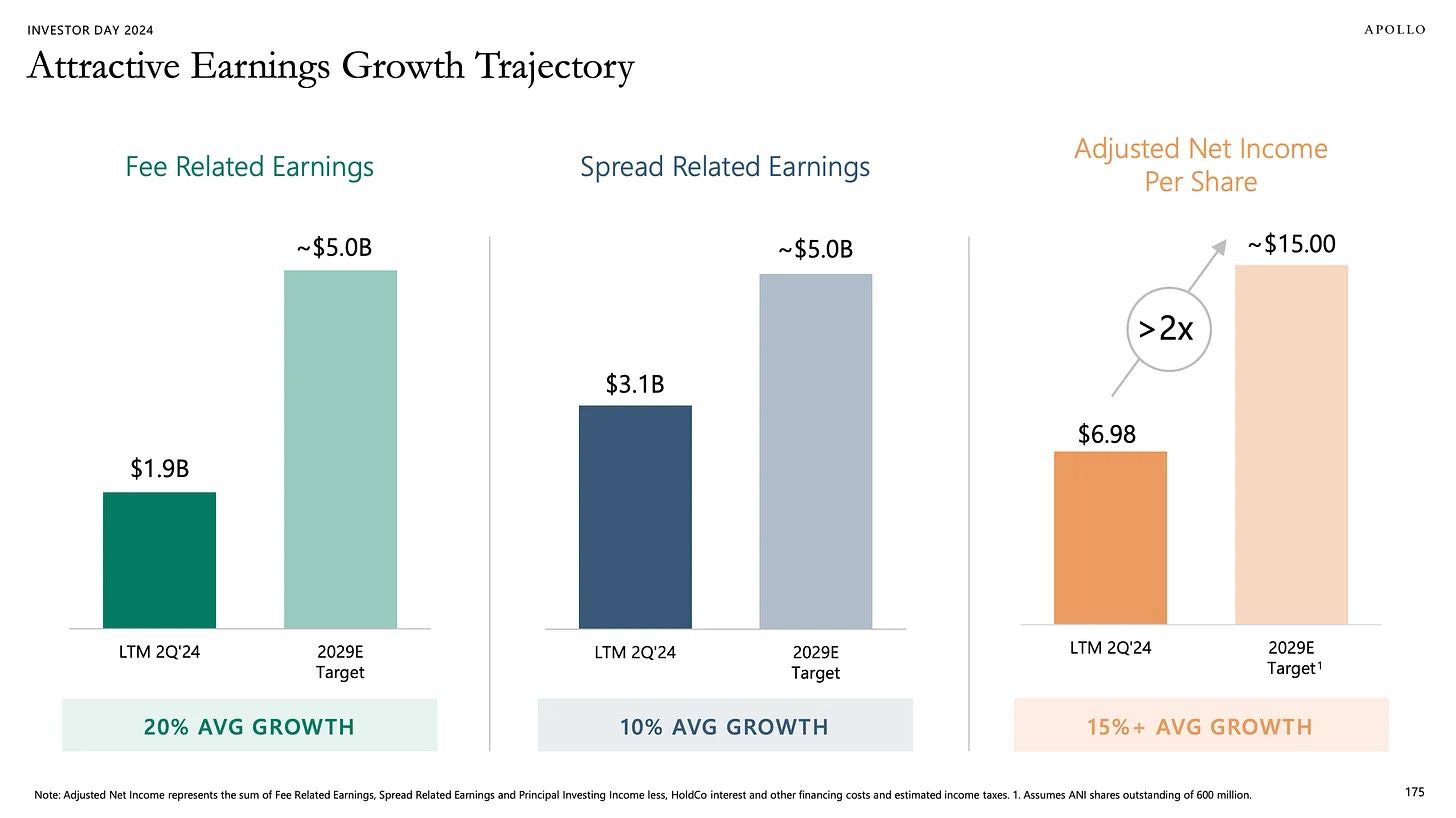

The management is confident that this engine will generate a +15% CAGR in Net Income until 2029, mainly due to the growth of FRE.

A superior investor

Apollo is a Tier 1 alternative investment company, playing in the same Blackstone, KKR, and Brookfield leagues.

Differently from its other peers, Apollo’s AUM shows peculiarities:

~80% of AUM is invested in credit (KKR ~43%, Blackstone 33%);

~60% of AUM is “perpetual” (=indefinite duration), which comes from Athene (KKR ~42%, Blackstone ~40%);

Despite being considerably bigger, Apollo Credit AUM grows faster than KKR’s and BX’s.

Apollo realized early that Perpetual Capital could scale AUM better by making it less dependent on fundraising dynamics.

In recent years, KKR and Blackstone bought insurance companies Global Atlantic and parts of AIG to replicate Apollo. However, these acquisitions don’t exhibit the same operational or strategic synergy level as Apollo-Athene.

Apollo built its reputation thanks to a prolonged outperformance of its flagship investment funds compared to benchmarks.

Apollo is able to generate more returns per unit of risk.

What’s the key to this success?

Athene.

Perpetual stream of inflows

Athene is the #1 Retail Annuities provider with a 12% market share and still taking market share:

An annuity is a contract where clients purchase a regular stream of future payments:

“I give you $100k. You give me $4k until I die.”

Athene takes that money and reinvests it in assets that generate higher returns.

Athene’s business could be summarized as follows:

receives funding promising a return (e.g. 4%);

invests in assets that yield +1.5/2% more (e.g. 5.5%);

keeps the difference, net of operating costs, generating a ~1.3% spread (“SRI”).

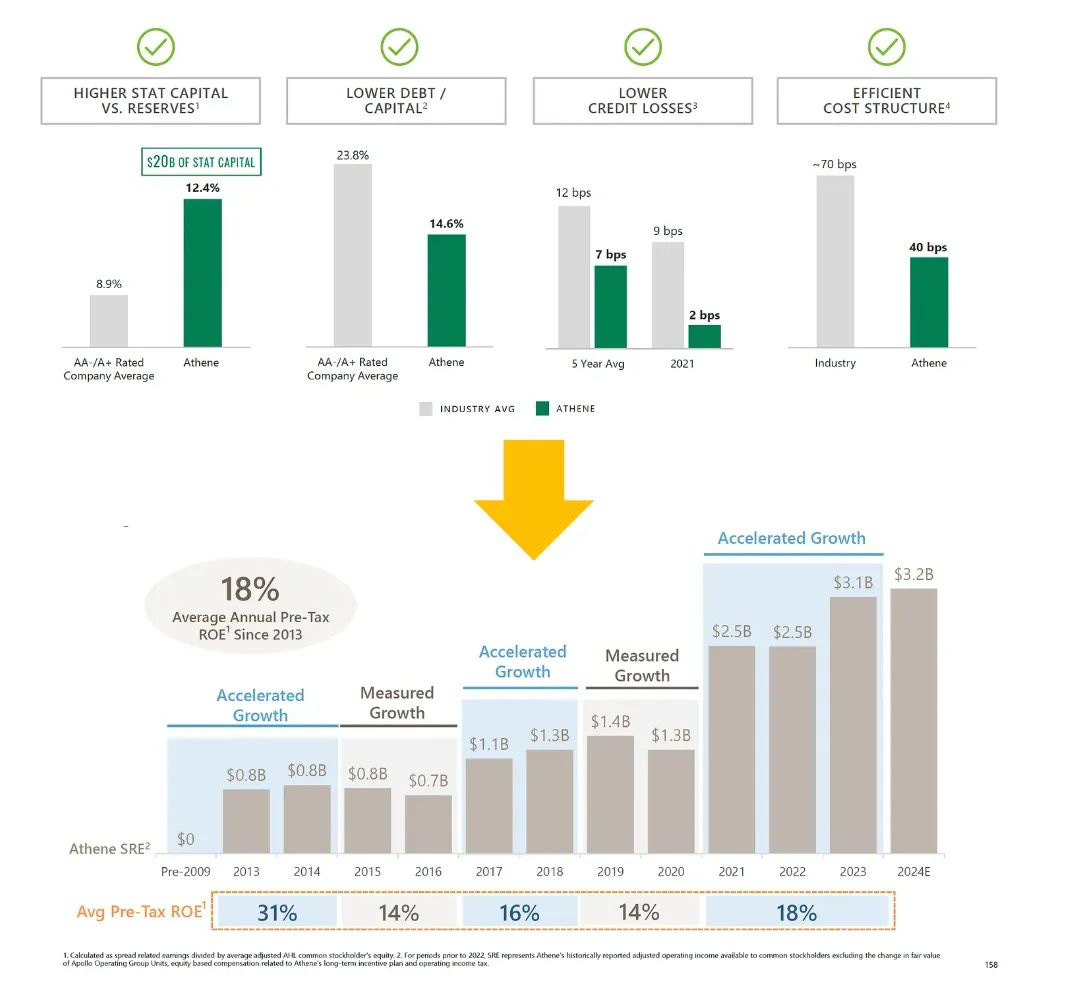

Athene is just the best in executing the business:

more secure Statutory Capital;

better cost structure;

lower credit losses.

These factors allow Athene to generate ~18% Return on Equity.

To ensure Athene can always repay its clients and sustain its 10-12x leverage safely, it must invest mainly in investment-grade (the safest) credits.

Athene’s Retirement Services is a highly stable growth business:

it receives a steady stream of capital regardless of market conditions (retirement solutions are always needed);

85% of funds either have a withdrawal penalty or are not withdrawable;

8 years avg. life of funding.

These funding characteristics are particularly intriguing for a skilled capital allocator like Apollo AM, who can use that cash to create superior risk-adjusted opportunities.

The flywheel

Apollo and Athene’s symbiotic relationship generates powerful flywheel effects:

Apollo's AM focuses on origination activities, such as arranging loans and investments. If Apollo originates a loan, it may manage a fund that invests in it (generating FRE), while Athene invests its capital in the same loan (generating SRE). This shared platform means that as AUM grows and FRE increases, Athene has more investment opportunities to deploy capital, thus boosting SRE.

Apollo's AM asset management expertise is leveraged to manage Athene's investment portfolio, enhancing returns and SRE. The same investment team and strategies that drive FRE also contribute to Athene's performance, directly linking the two earnings streams.

Apollo's reputation attracts more customers to Athene's annuity products. Clients of Apollo AM can also invest in Athene’s products, linking FRE growth to increased premiums and SRE.

When you have the capital and the skill to allocate, the only limit is sourcing assets where you can deploy that capital.

Why search when you can create?

Vertical Integration: Originating alpha

People often think that the factor that constrains the alternative investment industry is the ability to raise capital.

In reality, the ability to originate deals is the most critical factor.

In private credit, “origination” means creating or granting loans. In other words; financing.

To solve this issue, Apollo spent 10 years and ~$8bn in equity building its recurring origination engine, which creates assets not available in public markets.

Apollo calls this engine the “origination platform,” which currently generates +$72bn annually (45% of the total origination) and is expected to contribute even more.

The origination platform enables Apollo to generate an additional ~1-2% excess spread for a similar level of credit risk, particularly in Investment Grade (the safest category), where capital is deployed.

Apollo’s vertical integration leads to less economic leakage and excess return.

Here is the genius part.

Apollo controls the origination platform with its Private Equity funds. This means that Apollo:

maintains control of the origination platform while getting paid fees;

is incentivized to build the origination platform for the long term (more fees);

generate syndication fees when originated assets are sold to other investors.

The origination platform provides a perpetual and recurring supply that consolidates Apollo’s advantage.

By controlling the origination platform, Apollo has:

complete due diligence and a comprehensive relationship with borrowers;

the opportunity to choose and price risks better;

the chance to generate syndication fees.

The underlying idea that makes origination powerful is that Apollo focuses on the credit risk rather than the liquidity risk.

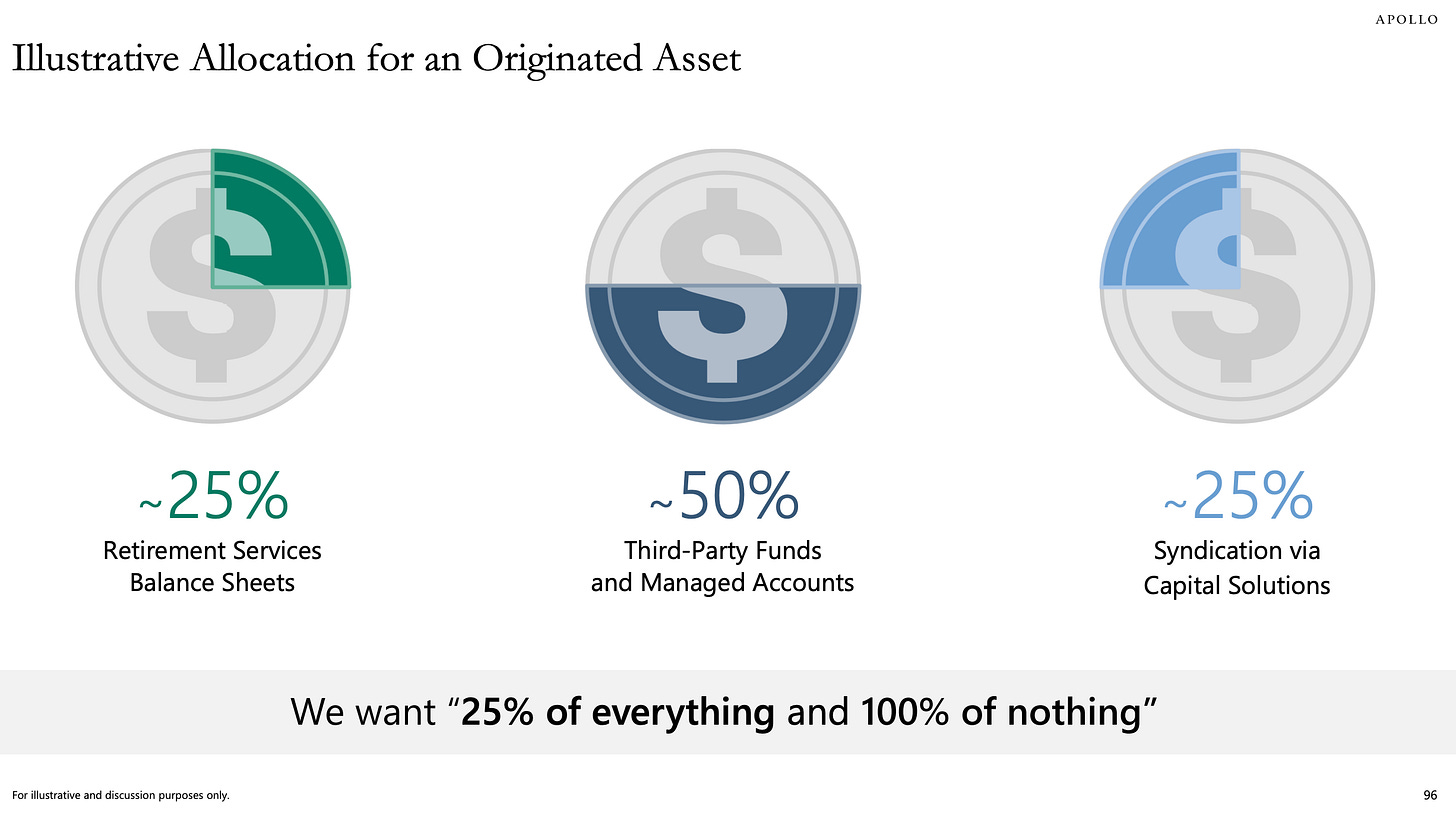

The originated assets feed the entire business:

25% goes to Athene’s balance sheet;

50% goes into Apollo’s funds;

25% is sold via Syndication to other investors.

This means that the more assets are generated, the more opportunities there are for Athene and Apollo to deploy capital at an attractive risk-adjusted return while also receiving fees for the excess origination sold via syndication to other industry players like banks and hedge funds.

Apollo is the financial partner of choice:

In a world where banks are constrained in their lending by strict capital requirements, Apollo is becoming the partner of choice for financial needs.

Banking is risky because it requires gathering assets (deposits) in the short term and lending them in the long term, creating a structural asset-liability mismatch.

On the other side, Apollo has a similar duration profile between its liabilities (Athene’s inflows) and the assets it invests into, making it structurally more resilient than a bank.

As banks retreat, Apollo faces a massive opportunity to finance the secular need for Capex, especially those linked to the AI revolution:

+$30-50T in Energy Transition;

+30T in Power & Utilities;

+$15-20T in Digital Infrastructure.

The oil that accelerates the engine

To further reinforce the flywheel, Apollo created Apollo Capital Solutions (“ACS”), which is essentially an internal “investment banking division” to:

facilitate the creation of high-quality assets;

gather new inflows from the Wealth segment;

generate syndication fees by helping distribute the originated assets.

As of Q4, ACS's revenue had grown 38% YoY to ~$600mn (~17% of the FRE) and is expected to double by 2029.

ACS sells to other players the “excess origination” not deployed by Athene and Apollo AM.

This means Apollo can also benefit from the growth of its competitors in a rapidly developing industry.

The $50T opportunity to reshape public vs private

Apollo believes alternatives are set to become a crucial component of institutional investors' portfolio allocations (now ~5/10% of portfolios), which typically seek an 8% target return.

Supporting this trend:

equity markets are over-indexed and at high multiples;

public bonds offer no alpha;

“liquidity” is superfluous when you invest for the long run.

These conditions create a massive opportunity for Apollo to provide the products the industry needs, starting from private debt solutions and later reaching “equity that is private.”

In substance, Apollo is preparing to release several products, including funds and ETFs, to address the need for higher returns per unit of risk.

Apollo is the only asset manager seeing this massive opportunity because approaching this market requires a complete ecosystem:

substantial ability to originate;

enormous capital to deploy that requires a target yield profile;

ability to grow while preserving low costs and persistent funding.

God is cheap

Beyond its funds, Apollo showed its investing capability by purchasing Athene at a deep discount (~7x PE, ~0.6x PB).

Furthermore, as the stock dropped below 15x PE, Apollo purchased ~2% of its shares, generating a ~50% return in ~6 months.

Apollo trades at less than 20x PE, substantially lower than other leading alternative investment companies. While KKR and Blackstone shine for their execution, Apollo is playing a more intelligent game that should pay off with time.

Further evidence comes from Blackrock, which recently bought the alternative credit investor HPS at ~30x PE multiple.

If Apollo traded in line with peers, it would benefit from a ~50% upside from multiple expansions alone.

Apollo is unjustifiedly the cheapest player.

Since Apollo acquired Athene, markets have assigned Apollo a lower multiple. Insurance companies typically trade at low multiples due to their constrained growth ability.

In reality, Athene solidifies Apollo’s AM capital-light business, solidifying its competitive advantage, so I believe there is no rational reason for the discount.

Building a perpetual stream of high-quality inflows like Athene requires a lot of capital and time. Hence, it’s tough for new competitors to challenge Athene’s dominance and, therefore, Apollo’s positioning. E.g. Amazon’s logistic arm solidifies its dominion in the capital-light business of e-commerce.

Even if a multiple expansion didn’t occur, the stock could compound at ~ a 15% CAGR based on the EPS growth from executing the business plan.

That would already be sufficient to exceed the S&P500 average return.

Mitigated risks

The key risks I see for Apollo:

Changes in market conditions affect GAAP numbers. Apollo needs to record investment gains and losses as Revenue despite not affecting the Revenue the business generates. This is more of a headline risk than a substance risk.

A significant debt crisis would affect Apollo’s results in the short term. Yet, that would be a condition for leveraging its immense capital and skill to acquire appealing assets at a deep discount, as it did during the 2008 crisis.

Mark Rowan, Co-Founder, is a terrific visionary CEO, so there is a key man risk. This risk is mitigated, however, as Rowan signed a 5-year extension in January 2025.

Conclusion

Apollo is a generational compounder that leverages a highly synergic engine to capitalize on the massive opportunity to reshape the financial industry.

The current price underestimates the massive opportunity Apollo is set to capture, creating an asymmetric opportunity.

Low risk, high return is possible.

Yours,

Arny

Thank you @EmanueleCalvo7, , for helping me with this research!

Reach me:

Disclaimer: The views and opinions expressed above are current as of the date of this document and are subject to change without notice. Materials referenced above will be provided for educational purposes only. None of the above will include investment advice, a recommendation or an offer to sell, or a solicitation of an offer to buy, any securities or investment products

Thank you for sharing this in-depth analysis. In a world filled with simplistic "this stock will skyrocket" articles, it's refreshing to read something intelligent every now and then!

Excellent. Apollo is the definition of fly wheel